Growing Awareness of Eye Health

There is a notable increase in public awareness regarding eye health in France, which is driving the ophthalmic drugs devices market. Campaigns promoting regular eye examinations and the importance of early detection of eye diseases are gaining traction. This heightened awareness is leading to more individuals seeking preventive care and treatment options, thereby increasing the demand for ophthalmic products. Furthermore, educational initiatives by healthcare professionals are encouraging patients to prioritize their eye health, which is likely to result in a more proactive approach to managing eye conditions. As a result, the France ophthalmic drugs devices market is expected to benefit from this growing consciousness about eye health.

Government Initiatives and Funding

Government initiatives aimed at improving eye health are playing a crucial role in the France ophthalmic drugs devices market. The French government has implemented various programs to enhance access to eye care services, including funding for research and subsidies for ophthalmic devices. These initiatives are designed to reduce the burden of eye diseases on the healthcare system and improve patient access to necessary treatments. For example, the French Ministry of Health has allocated significant resources to promote awareness and prevention of eye disorders, which is likely to stimulate demand for ophthalmic drugs and devices. Such supportive policies are expected to foster growth within the France ophthalmic drugs devices market.

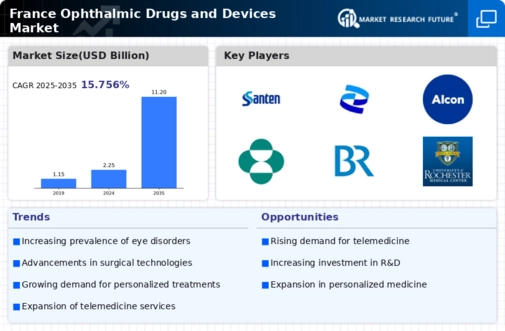

Rising Prevalence of Eye Disorders

The increasing prevalence of eye disorders in France is a primary driver for the ophthalmic drugs devices market. Conditions such as cataracts, glaucoma, and age-related macular degeneration are becoming more common, particularly among the aging population. According to recent statistics, approximately 30% of individuals over the age of 65 in France experience some form of visual impairment. This demographic shift necessitates a greater demand for effective ophthalmic treatments and devices, thereby propelling market growth. The France ophthalmic drugs devices market is likely to see a surge in product development aimed at addressing these prevalent conditions, as healthcare providers seek innovative solutions to improve patient outcomes.

Technological Innovations in Ophthalmic Treatments

Technological advancements in ophthalmic devices are significantly influencing the France ophthalmic drugs devices market. Innovations such as minimally invasive surgical techniques, advanced diagnostic tools, and smart contact lenses are enhancing treatment efficacy and patient comfort. For instance, the introduction of femtosecond laser technology has revolutionized cataract surgery, leading to quicker recovery times and improved visual outcomes. The market is projected to grow as manufacturers invest in research and development to create cutting-edge products that meet the evolving needs of healthcare professionals and patients alike. This trend indicates a robust future for the France ophthalmic drugs devices market, driven by continuous innovation.

Aging Population and Increased Healthcare Expenditure

The aging population in France is a significant driver of the ophthalmic drugs devices market. As the demographic landscape shifts, there is a corresponding rise in healthcare expenditure related to age-related eye conditions. The French government and private sector are investing heavily in healthcare services to accommodate the needs of older adults, which includes funding for ophthalmic treatments and devices. This trend is expected to continue, as the proportion of individuals aged 65 and older is projected to increase, leading to a higher demand for specialized eye care. Consequently, the France ophthalmic drugs devices market is likely to experience substantial growth as healthcare systems adapt to these demographic changes.