Growing Awareness of Eye Health

The growing awareness of eye health among the Japanese population is a pivotal driver for the japan ophthalmic drugs devices market. Public health campaigns and educational initiatives have been instrumental in informing citizens about the importance of regular eye check-ups and early detection of eye diseases. As a result, more individuals are seeking preventive care and treatment options, leading to increased demand for ophthalmic drugs and devices. Furthermore, the rise of digital technology and screen usage has heightened concerns regarding eye strain and related disorders, prompting consumers to invest in eye care solutions. This heightened awareness is expected to continue influencing the market positively, as more people prioritize their eye health in the coming years.

Aging Population and Rising Eye Disorders

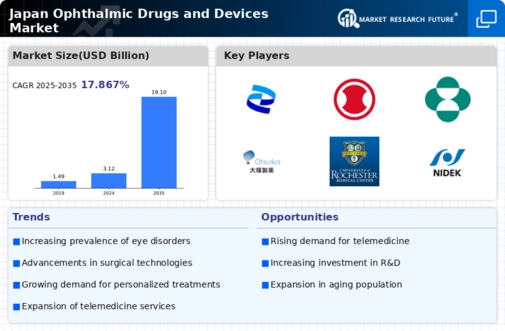

The aging population in Japan is a significant driver for the japan ophthalmic drugs devices market. As the demographic shifts towards an older age group, the prevalence of age-related eye disorders, such as cataracts and macular degeneration, is expected to rise. According to government statistics, approximately 30% of the population is projected to be over 65 by 2030, leading to increased demand for ophthalmic treatments and devices. This demographic trend necessitates advancements in both surgical and pharmaceutical interventions, thereby propelling the market forward. Furthermore, the growing awareness of eye health among the elderly is likely to enhance the uptake of preventive measures and treatments, further stimulating the japan ophthalmic drugs devices market.

Regulatory Support and Market Accessibility

Regulatory support plays a vital role in shaping the japan ophthalmic drugs devices market. The Japanese government has implemented policies aimed at facilitating the approval and commercialization of innovative ophthalmic products. Initiatives such as the Pharmaceuticals and Medical Devices Agency (PMDA) streamline the regulatory process, allowing for quicker access to new treatments and technologies. This supportive regulatory environment encourages both domestic and international companies to invest in the Japanese market, fostering competition and innovation. As a result, the availability of diverse ophthalmic drugs and devices is likely to increase, meeting the growing needs of the population and driving the overall growth of the japan ophthalmic drugs devices market.

Technological Innovations in Ophthalmic Devices

Technological advancements in ophthalmic devices are transforming the landscape of the japan ophthalmic drugs devices market. Innovations such as minimally invasive surgical techniques, advanced imaging systems, and smart contact lenses are enhancing diagnostic accuracy and treatment efficacy. For instance, the introduction of femtosecond laser technology has revolutionized cataract surgery, improving patient outcomes and recovery times. The Japanese government has been supportive of research and development initiatives, providing funding and resources to foster innovation in this sector. As a result, the market is witnessing a surge in the adoption of cutting-edge technologies, which is likely to drive growth and expand the range of available treatment options in the japan ophthalmic drugs devices market.

Increased Health Expenditure and Insurance Coverage

Rising health expenditure in Japan is a crucial factor influencing the japan ophthalmic drugs devices market. The government has been increasing its healthcare budget, which has led to improved access to ophthalmic care and treatments. Additionally, the expansion of insurance coverage for eye care services has made it more affordable for patients to seek necessary treatments. According to recent reports, healthcare spending in Japan is expected to reach 12 trillion yen by 2025, with a significant portion allocated to ophthalmic care. This financial support is likely to encourage more individuals to pursue eye examinations and treatments, thereby driving demand within the japan ophthalmic drugs devices market.