Rising Energy Costs

The escalating costs of traditional energy sources are propelling the Fuel Cell for Data Center Market forward. As energy prices continue to rise, data centers are increasingly seeking alternative energy solutions that offer cost stability and efficiency. Fuel cells, known for their high efficiency and lower operational costs, present a compelling case for data center operators. The market is witnessing a shift as organizations recognize the potential for fuel cells to mitigate energy expenses. In recent years, the average cost of electricity has surged, prompting data centers to explore innovative energy solutions. By investing in fuel cell technology, data centers can not only reduce their energy bills but also enhance their overall operational efficiency, making this driver particularly influential in the current market landscape.

Demand for Reliable Power Sources

The quest for reliable and uninterrupted power sources is a critical driver for the Fuel Cell for Data Center Market. Data centers require constant power to maintain operations, and fuel cells offer a dependable solution that can operate independently of the grid. This reliability is particularly crucial in regions prone to power outages or fluctuations. As organizations prioritize uptime and service continuity, the adoption of fuel cells is likely to increase. The market is projected to grow as data centers recognize the advantages of integrating fuel cells into their energy mix. In 2025, the demand for reliable power solutions is expected to escalate, further solidifying the position of fuel cells as a key player in the energy landscape for data centers.

Regulatory Support for Clean Energy

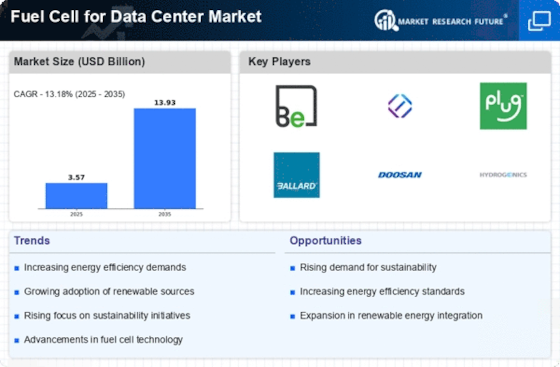

The increasing emphasis on clean energy solutions is driving the Fuel Cell for Data Center Market. Governments are implementing stringent regulations aimed at reducing carbon emissions, which encourages data centers to adopt cleaner technologies. For instance, incentives and subsidies for renewable energy projects are becoming more prevalent, making fuel cells an attractive option. The market is projected to grow as organizations seek compliance with these regulations while also enhancing their sustainability profiles. In 2025, the fuel cell market is expected to witness a compound annual growth rate of approximately 20%, reflecting the urgency to transition to cleaner energy sources. This regulatory support not only fosters innovation but also positions fuel cells as a viable alternative to traditional energy sources in data centers.

Corporate Sustainability Initiatives

The growing trend of corporate sustainability initiatives is significantly impacting the Fuel Cell for Data Center Market. Companies are increasingly committing to reducing their carbon footprints and enhancing their environmental responsibility. This shift is prompting data centers to explore cleaner energy alternatives, with fuel cells emerging as a viable option. Many organizations are setting ambitious sustainability goals, which often include transitioning to renewable energy sources. The market is likely to benefit from this trend as more data centers adopt fuel cell technology to align with corporate sustainability objectives. In 2025, it is anticipated that a substantial percentage of data centers will integrate fuel cells into their energy strategies, reflecting the broader commitment to sustainability across various sectors.

Technological Innovations in Fuel Cell Technology

Technological advancements in fuel cell technology are significantly influencing the Fuel Cell for Data Center Market. Innovations such as improved fuel cell efficiency, durability, and scalability are making these systems more appealing to data center operators. Recent developments have led to the creation of fuel cells that can operate on various fuels, including hydrogen and natural gas, thus broadening their applicability. The market is expected to expand as these technological improvements reduce the barriers to entry for data centers considering fuel cell adoption. In 2025, the fuel cell market is anticipated to reach a valuation of several billion dollars, driven by these innovations. As data centers increasingly prioritize energy efficiency and sustainability, the role of advanced fuel cell technologies becomes more pronounced.