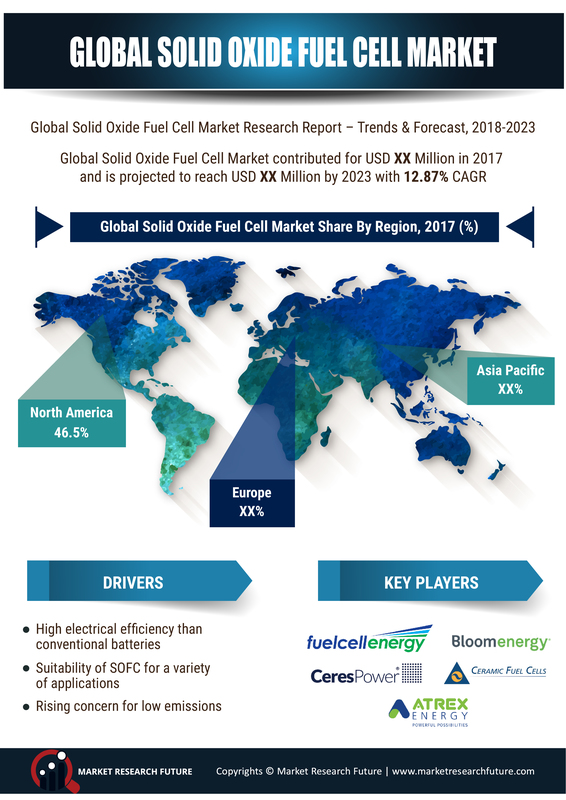

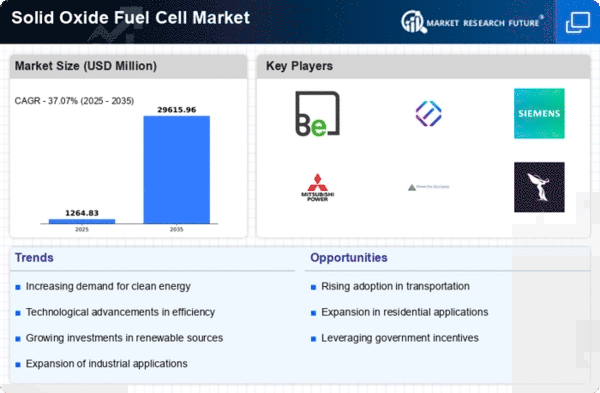

Market Growth Projections

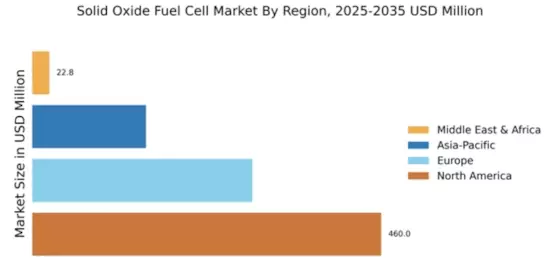

The Global Solid Oxide Fuel Cell Market Industry is poised for remarkable growth, with projections indicating a substantial increase in market value over the next decade. The market is expected to reach 922.8 USD Million in 2024, with an anticipated growth trajectory leading to an estimated value of 40,586.2 USD Million by 2035. This growth is underpinned by a compound annual growth rate (CAGR) of 41.06% from 2025 to 2035, reflecting the increasing adoption of solid oxide fuel cells across various applications. These projections highlight the industry's potential to become a cornerstone of the global energy landscape.

Government Initiatives and Funding

Government initiatives and funding are instrumental in propelling the Global Solid Oxide Fuel Cell Market Industry forward. Various countries are allocating substantial financial resources to support research and development in fuel cell technologies. For example, the United States Department of Energy has been actively funding projects aimed at advancing solid oxide fuel cell technology. Such initiatives not only foster innovation but also create a favorable environment for market growth. As a result, the industry is anticipated to expand significantly, with projections suggesting a market value of 40,586.2 USD Million by 2035, driven by increased government support and investment.

Growing Applications in Various Sectors

The versatility of solid oxide fuel cells is a key driver for the Global Solid Oxide Fuel Cell Market Industry, as they find applications across various sectors. These fuel cells are utilized in stationary power generation, transportation, and even portable power applications. Their ability to operate on multiple fuels, including natural gas and biogas, enhances their appeal in diverse markets. The increasing adoption of solid oxide fuel cells in industrial applications, such as combined heat and power systems, is likely to further stimulate market growth. This broad applicability positions the industry for substantial expansion in the coming years.

Rising Demand for Clean Energy Solutions

The Global Solid Oxide Fuel Cell Market Industry is experiencing a surge in demand for clean energy solutions as nations strive to reduce carbon emissions and combat climate change. Governments worldwide are implementing stringent regulations and incentives to promote the adoption of renewable energy technologies. For instance, the European Union has set ambitious targets for carbon neutrality by 2050, which is likely to drive investments in solid oxide fuel cells. This shift towards cleaner energy sources is projected to contribute to the market's growth, with the industry expected to reach 922.8 USD Million in 2024, reflecting a growing preference for sustainable energy alternatives.

Environmental Regulations and Sustainability Goals

The Global Solid Oxide Fuel Cell Market Industry is significantly influenced by stringent environmental regulations and sustainability goals set by governments and organizations. As countries commit to reducing greenhouse gas emissions, there is a growing emphasis on adopting cleaner technologies. Solid oxide fuel cells, known for their high efficiency and low emissions, align well with these sustainability objectives. The increasing pressure on industries to comply with environmental standards is likely to drive the adoption of solid oxide fuel cells, positioning the market for robust growth. This trend underscores the importance of sustainable energy solutions in achieving global climate targets.

Technological Advancements in Fuel Cell Technology

Technological advancements play a crucial role in the Global Solid Oxide Fuel Cell Market Industry, enhancing the efficiency and performance of fuel cells. Innovations in materials, such as the development of advanced electrolytes and catalysts, are likely to improve the overall efficiency of solid oxide fuel cells. These advancements not only reduce production costs but also increase the lifespan and reliability of the systems. As a result, the market is expected to witness significant growth, with projections indicating a remarkable CAGR of 41.06% from 2025 to 2035. This technological evolution is pivotal in making solid oxide fuel cells a viable option for various applications.