Food Thickeners Market Summary

As per Market Research Future analysis, The Global Food Thickeners Market was estimated at 9.42 USD Billion in 2024. The food thickeners industry is projected to grow from 9.978 USD Billion in 2025 to 17.73 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.92% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Food Thickeners Market is experiencing a dynamic shift towards health-conscious and clean-label products.

- The market is witnessing a rise in clean-label products, reflecting consumer demand for transparency in food ingredients.

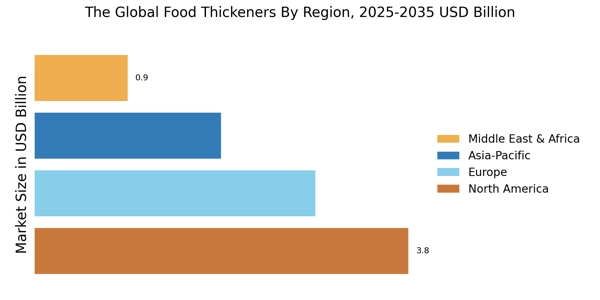

- North America remains the largest market for food thickeners, while Asia-Pacific is emerging as the fastest-growing region.

- Starch thickeners dominate the market, whereas hydrocolloids are gaining traction as the fastest-growing segment.

- Growing health consciousness and the expansion of the food and beverage sector are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 9.42 (USD Billion) |

| 2035 Market Size | 17.73 (USD Billion) |

| CAGR (2025 - 2035) | 5.92% |

Major Players

Cargill (US), Archer Daniels Midland Company (US), Tate & Lyle (GB), DuPont (US), Ingredion (US), Kerry Group (IE), CP Kelco (US), FMC Corporation (US), Ashland Global Holdings (US), Royal DSM (NL)