Health and Wellness Trends

The Food Processing Ingredients Market is increasingly influenced by the rising health and wellness trends among consumers. There is a growing preference for ingredients that promote health benefits, such as natural sweeteners, whole grains, and functional additives. Market data indicates that the health-focused food segment is anticipated to grow by around 5% annually, reflecting a shift towards healthier eating habits. This trend compels food manufacturers to reformulate their products, thereby increasing the demand for specialized food processing ingredients that align with health-conscious consumer preferences. As a result, the Food Processing Ingredients Market is likely to see a diversification of its ingredient portfolio to cater to this evolving consumer landscape.

Regulatory Changes and Compliance

The Food Processing Ingredients Market is significantly impacted by regulatory changes and compliance requirements. Governments worldwide are increasingly implementing stringent regulations regarding food safety, labeling, and ingredient transparency. These regulations compel food manufacturers to reformulate their products and ensure compliance, which in turn drives the demand for specific food processing ingredients that meet these standards. For example, the introduction of new labeling requirements for allergens and additives has led to a heightened focus on ingredient sourcing and transparency. Consequently, the Food Processing Ingredients Market must adapt to these regulatory landscapes, which may result in increased operational costs but also presents opportunities for innovation and differentiation in product offerings.

Increasing Demand for Convenience Foods

The Food Processing Ingredients Market is experiencing a notable surge in demand for convenience foods. This trend is largely driven by the fast-paced lifestyles of consumers who seek quick meal solutions without compromising on quality. According to recent data, the convenience food segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is likely to propel the demand for various food processing ingredients, such as preservatives, emulsifiers, and flavor enhancers, which are essential for maintaining the taste and shelf-life of these products. As manufacturers strive to meet consumer expectations, the Food Processing Ingredients Market is expected to adapt by innovating and expanding its offerings to include more convenient solutions.

Emerging Markets and Consumer Preferences

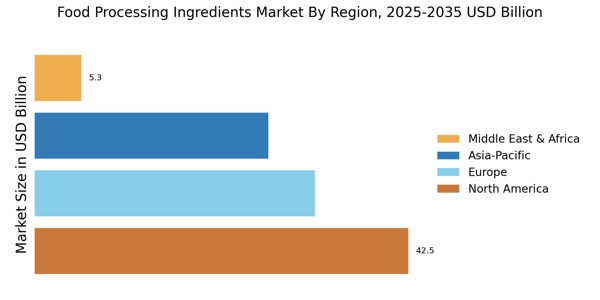

Emerging markets are becoming a focal point for the Food Processing Ingredients Market, as changing consumer preferences in these regions create new opportunities. As disposable incomes rise, consumers in these markets are increasingly seeking diverse food options, including processed and packaged foods. This shift is expected to drive the demand for various food processing ingredients, such as stabilizers and thickeners, which are essential for enhancing product quality. Market analysis suggests that the growth rate in these emerging regions could reach 6% annually, reflecting a robust appetite for innovative food products. As a result, the Food Processing Ingredients Market is likely to expand its reach and tailor its offerings to meet the unique tastes and preferences of consumers in these developing economies.

Technological Advancements in Food Processing

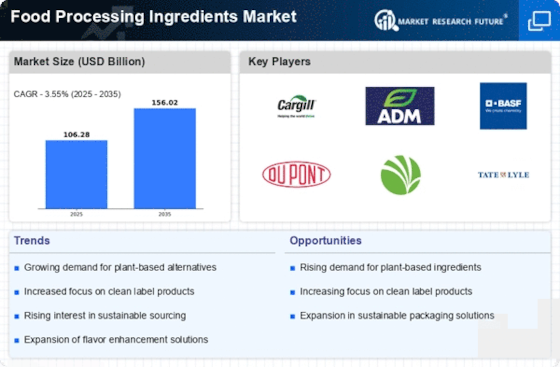

Technological advancements are playing a pivotal role in shaping the Food Processing Ingredients Market. Innovations in processing techniques, such as high-pressure processing and advanced extraction methods, are enhancing the quality and functionality of food ingredients. These technologies not only improve the efficiency of food production but also enable the development of new ingredients that meet specific consumer needs. For instance, the use of enzyme technology has led to the creation of healthier fats and oils, which are gaining traction in the market. As these technologies continue to evolve, the Food Processing Ingredients Market is expected to benefit from increased efficiency and product innovation, potentially leading to a market growth rate of 3.5% over the next few years.