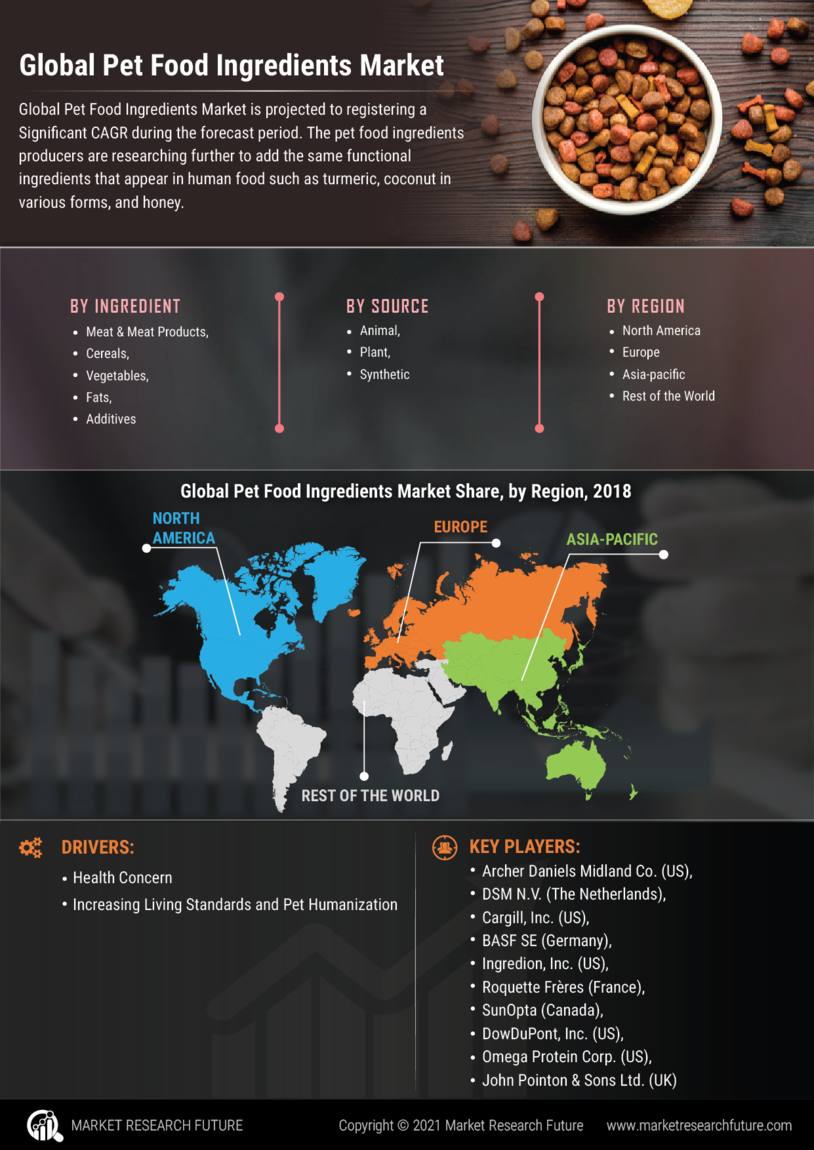

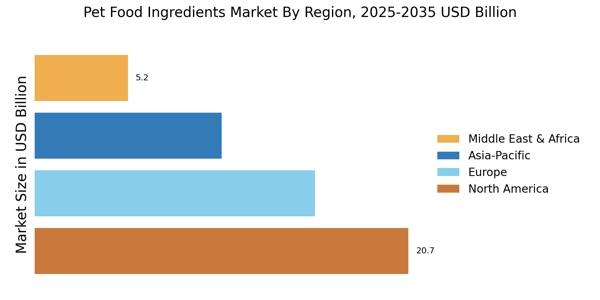

North America : Market Leader in Pet Food

North America is the largest region for Pet Food Ingredients Market, accounting for approximately 40% of the global market share. The region's growth is driven by increasing pet ownership, a rising trend towards premium pet food, and stringent regulations ensuring food safety and quality. The demand for natural and organic ingredients is also on the rise, supported by consumer awareness and health trends. The United States is the leading country in this region, with major players like Nestle Purina PetCare, Mars Petcare, and Hill's Pet Nutrition dominating the market. The competitive landscape is characterized by innovation in product offerings and a focus on sustainability. Canada also plays a significant role, contributing to the overall growth with its own set of key players like Champion Petfoods.

Europe : Emerging Trends in Pet Nutrition

Europe is witnessing a significant shift towards premium and specialized pet food ingredients, holding approximately 30% of the global Pet Food Ingredients Market share. The growth is fueled by increasing pet ownership, a focus on pet health, and regulatory frameworks that promote high-quality standards. Countries like Germany and the UK are leading this trend, with a growing demand for organic and natural ingredients, supported by EU regulations on food safety and labeling. Germany stands out as the largest market in Europe, followed closely by the UK. The competitive landscape is marked by the presence of established brands like Royal Canin and emerging local players. The region is also seeing innovations in ingredient sourcing and formulations, catering to the evolving preferences of pet owners. The European market is adapting to consumer demands for transparency and sustainability in pet food production.

Asia-Pacific : Rapid Growth in Pet Ownership

Asia-Pacific is rapidly emerging as a significant player in the Pet Food Ingredients Market, accounting for about 20% of the global share. The region's growth is driven by increasing disposable incomes, urbanization, and a growing trend of pet humanization. Countries like China and Japan are leading this growth, with rising demand for premium and specialized pet food products, supported by evolving consumer preferences and regulatory improvements in food safety standards. China is the largest market in the region, with Japan following closely. The competitive landscape features both international brands and local manufacturers, creating a dynamic market environment. Key players are focusing on innovation and product differentiation to capture the growing consumer base. The region is also witnessing a surge in e-commerce platforms, making pet food more accessible to consumers.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa represent an emerging Pet Food Ingredients Market , holding approximately 10% of the global market share. The growth is driven by increasing pet ownership, particularly in urban areas, and a rising awareness of pet nutrition. Regulatory frameworks are gradually evolving to support the industry, although challenges remain in terms of supply chain and distribution. Countries like South Africa and the UAE are at the forefront of this growth, with a focus on premium products. South Africa is the largest market in the region, with the UAE showing significant potential for growth. The competitive landscape is characterized by a mix of local and international players, with increasing investments in product development and marketing strategies. The region is also seeing a rise in demand for natural and organic ingredients, reflecting global trends in pet food consumption.

South America Market: Steady Market

The Brazil pet food ingredients market is a crucial part of South America market and is undergoing a rapid evolution toward premiumization and wellness, driven by a deep-rooted cultural shift where pets are increasingly integrated as core family members.