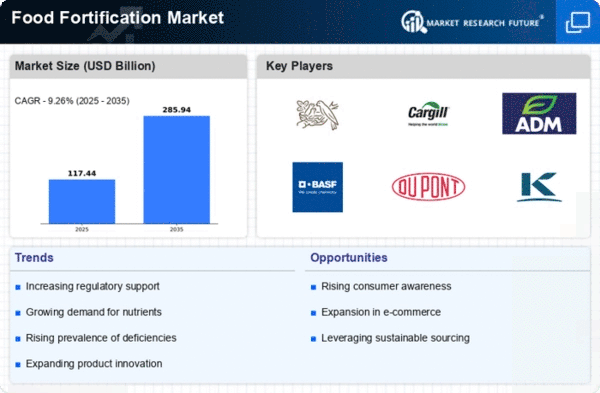

Market Growth Projections

The Global Food Fortification Industry is poised for substantial growth in the coming years. Projections indicate that the market will reach 139.1 USD Billion in 2024 and is expected to expand to 282.2 USD Billion by 2035. This growth trajectory reflects an anticipated CAGR of 6.64% from 2025 to 2035. Factors contributing to this growth include increasing awareness of nutritional deficiencies, government regulations promoting fortification, and rising consumer demand for healthier food options. As the market evolves, it is likely to witness innovations in fortification technologies and an expansion of product offerings, further driving its development.

Rising Nutritional Deficiencies

The Global Food Fortification Industry is driven by the increasing prevalence of nutritional deficiencies worldwide. According to various health organizations, deficiencies in essential vitamins and minerals, such as iron, vitamin A, and folic acid, affect billions of individuals, particularly in developing regions. This has prompted governments and organizations to implement fortification programs aimed at improving public health. For instance, initiatives in countries like India and Nigeria have led to the fortification of staple foods, which is expected to enhance the nutritional status of populations. The market is projected to reach 139.1 USD Billion in 2024 as these efforts gain momentum.

Government Initiatives and Regulations

Government initiatives play a pivotal role in shaping the Global Food Fortification Industry. Many countries have established mandatory fortification policies to combat malnutrition and improve public health outcomes. For example, the United States has mandated the fortification of certain foods with folic acid to reduce neural tube defects. Similarly, countries like Brazil and South Africa have implemented regulations to fortify staple foods with essential nutrients. These regulatory frameworks not only encourage manufacturers to adopt fortification practices but also ensure that fortified products reach vulnerable populations. As a result, the market is anticipated to grow significantly, potentially reaching 282.2 USD Billion by 2035.

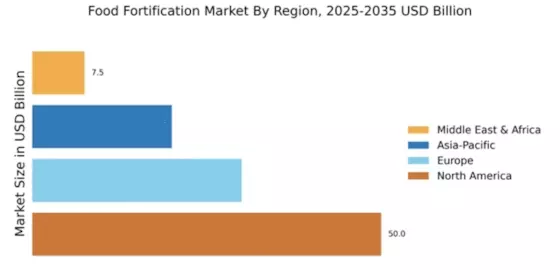

Globalization and Trade of Fortified Foods

The globalization of food trade is another significant driver of the Global Food Fortification Industry. As countries engage in international trade, the demand for fortified foods is increasing, particularly in regions with high import rates of staple foods. This trend is evident in the growing export of fortified products from countries like the United States and the European Union to developing nations. Additionally, trade agreements often include provisions for food fortification, promoting the availability of fortified foods in global markets. This interconnectedness is likely to facilitate market growth, as fortified foods become more accessible to diverse populations.

Consumer Awareness and Demand for Healthier Options

There is a growing consumer awareness regarding health and nutrition, which significantly influences the Global Food Fortification Industry. Consumers are increasingly seeking products that offer enhanced nutritional benefits, leading to a surge in demand for fortified foods. This trend is particularly evident in developed markets, where health-conscious consumers are willing to pay a premium for fortified products. For instance, the popularity of fortified cereals and beverages has risen, reflecting a shift towards healthier dietary choices. This heightened demand is likely to drive market growth, contributing to a projected CAGR of 6.64% from 2025 to 2035.

Technological Advancements in Fortification Processes

Technological advancements are transforming the Global Food Fortification Industry by enabling more efficient and effective fortification processes. Innovations in food processing technologies, such as microencapsulation and improved blending techniques, enhance the stability and bioavailability of added nutrients. These advancements allow manufacturers to produce fortified foods that retain their nutritional value over time. For example, the use of microencapsulation techniques has been shown to improve the stability of vitamins in fortified products. As these technologies become more accessible, they are expected to drive the adoption of fortification practices across various food categories, further expanding the market.