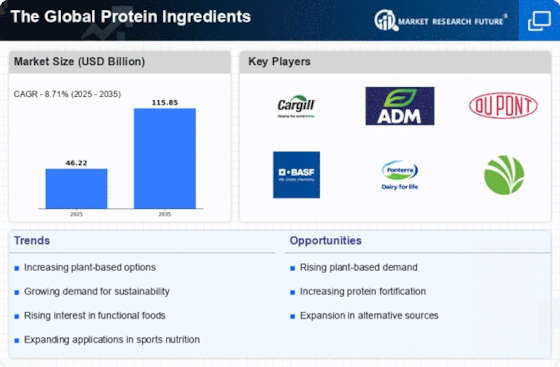

Increasing Health Consciousness

The rising awareness of health and wellness among consumers appears to be a pivotal driver for The Global Protein Ingredients Industry. Individuals are increasingly seeking protein-rich diets to support fitness goals, weight management, and overall health. This trend is reflected in the growing demand for protein supplements and fortified foods. According to recent data, the protein supplement segment is projected to witness a compound annual growth rate of approximately 8% over the next five years. As consumers prioritize nutritional value, manufacturers are responding by innovating and diversifying their product offerings, thereby enhancing the market landscape.

Growth of the Functional Foods Market

The functional foods market is expanding rapidly, which appears to be a significant driver for The Global Protein Ingredients Industry. Consumers are increasingly seeking foods that offer health benefits beyond basic nutrition, including enhanced immunity and digestive health. This trend is fostering the development of protein-enriched functional foods, such as protein bars and fortified beverages. Market Research Future indicates that the functional foods segment is projected to grow at a compound annual growth rate of approximately 7% over the next five years, thereby creating new opportunities for protein ingredient manufacturers.

Expansion of the Sports Nutrition Sector

The sports nutrition sector is experiencing notable growth, which seems to be significantly influencing The Global Protein Ingredients Industry. Athletes and fitness enthusiasts are increasingly incorporating protein supplements into their diets to enhance performance and recovery. Market data indicates that the sports nutrition segment is expected to reach a valuation of over 30 billion dollars by 2026. This surge is prompting manufacturers to develop specialized protein products tailored to the needs of this demographic, thereby driving innovation and competition within the market.

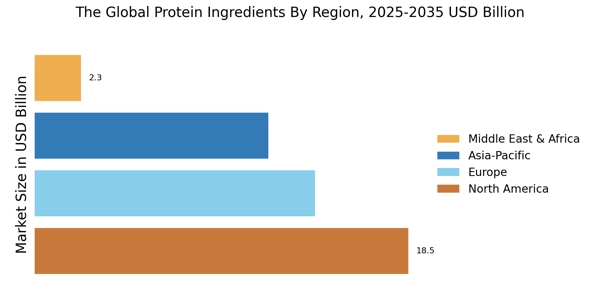

Rising Demand for Sustainable Protein Sources

Sustainability concerns are becoming increasingly prominent, potentially reshaping The Global Protein Ingredients Industry. Consumers are gravitating towards protein sources that are environmentally friendly and ethically produced. This shift is evident in the growing popularity of plant-based proteins, which are perceived as more sustainable compared to traditional animal-based proteins. Market analysis suggests that the plant-based protein segment could capture a significant share of the overall protein market, with projections indicating a growth rate of around 10% annually. This trend is compelling manufacturers to invest in sustainable practices and product development.

Technological Innovations in Protein Extraction

Technological advancements in protein extraction and processing are likely to play a crucial role in the evolution of The Global Protein Ingredients Industry. Innovations such as enzymatic hydrolysis and membrane filtration are enhancing the efficiency and quality of protein extraction. These technologies not only improve yield but also enable the production of high-purity protein ingredients that meet diverse consumer needs. As a result, manufacturers are increasingly adopting these technologies to stay competitive, which may lead to a more dynamic and responsive market environment.