Top Industry Leaders in the Flare Monitoring Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

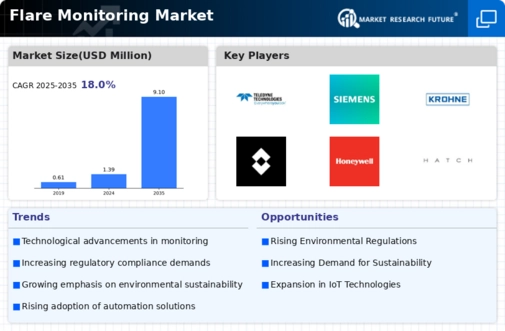

The flare monitoring market, fueled by environmental regulations and operational efficiency demands, is heating up with vigorous competition. Key players are not just focusing on traditional solutions, but also embracing advancements like AI, cloud computing, and data analytics to gain an edge. Let's delve into the strategies, trends, and dynamics shaping this dynamic market:

Key Players and Their Strategies:

Established Industry Leaders: Giants like ABB, Siemens AG, Honeywell International, and Emerson Electric leverage their diverse product portfolios, strong brand recognition, and global reach to maintain significant market share. Their established relationships with major oil & gas companies provide a secure customer base.

Technology-Focused Players: Companies like FLIR Systems and Geometrics Inc. are capitalizing on their expertise in thermal imaging and gas detection technologies. They offer advanced flare monitoring systems with real-time data visualization and cloud connectivity, catering to the growing demand for digitalization.

Regional Specialists: Local players like Spectronix (Asia) and AMETEK Land (North America) cater to specific regulations and needs of their regions. They often offer cost-effective solutions tailored to smaller refineries and emerging markets.

Factors for Market Share Analysis:

Product Portfolio Breadth: Offering a comprehensive range of solutions for different flare sizes, fuel types, and monitoring requirements is crucial. This includes hardware sensors, data acquisition systems, and software dashboards for analysis and reporting.

Technological Innovation: Companies that leverage AI for automated flare anomaly detection, cloud-based data management for remote monitoring, and predictive maintenance tools can stand out.

Compliance Expertise: Navigating the complex maze of environmental regulations across regions is vital. Players with proven expertise in helping clients comply with emission standards gain trust and market share.

Geographic Presence: A strong global presence with local technical support networks is essential for reaching a wider customer base, particularly in emerging markets with increasing industrial activity.

New and Emerging Trends:

Integration with Operational Technology (OT): Flare monitoring systems are increasingly being integrated with broader OT platforms, enabling real-time optimization of flare performance and overall plant efficiency.

Focus on Environmental Sustainability: Companies are developing solutions that not only monitor flares but also actively optimize combustion to minimize emissions and contribute to sustainability goals.

Rise of Data-Driven Services: Players are offering data analysis and optimization services based on historical flare data, helping clients identify operational inefficiencies and reduce downtime.

Adoption of Alternative Flaring Technologies: The market is seeing growing interest in technologies like plasma torches and closed-loop flare systems that aim to eliminate harmful emissions, presenting opportunities for niche players.

Overall Competitive Scenario:

The flare monitoring market is becoming increasingly competitive, with established players facing pressure from both smaller, technologically agile companies and regional specialists. While traditional strengths like product portfolio and brand recognition remain important, the future belongs to those who embrace innovation and cater to the growing demand for intelligent, data-driven solutions that address both environmental and operational concerns.

Providence Photonics:

- October 26, 2023: Providence Photonics announced the launch of its FlareScan FLR-G camera specifically designed for flare monitoring. It employs advanced hyperspectral imaging technology for accurate gas composition analysis and emission quantification. (Source: Providence Photonics Press Release)

ABB:

- September 20, 2023: ABB introduced its ABB Ability™ OptiFlow FLX210 flare flowmeter specifically designed for high-temperature and high-pressure flare applications. It provides accurate flare gas flow measurement for emissions reporting and optimization. (Source: ABB Website)

Siemens AG:

- October 4, 2023: Siemens launched its Sicam FlareOptimizer software solution for flare monitoring and optimization. It uses real-time data from various sensors and process parameters to optimize flare efficiency and minimize emissions. (Source: Siemens Press Release)

AMETEK:

- August 10, 2023: AMETEK launched its Rosemount™ X-Stream™ XH400 flowmeter for flare applications. It offers high accuracy and reliability for measuring flare gas flow under challenging conditions. (Source: AMETEK Website)

LumaSense Technologies: Announced a new partnership with a midstream natural gas company to implement its FlareWatchTM 400 camera system for comprehensive flare monitoring and emissions management. (Source: LumaSense Technologies press release, date unavailable)

Williamson Corporation: Unveiled a new ultrasonic flare gas flowmeter with improved accuracy and performance for harsh flare environments. (Source: Williamson Corporation website, date unavailable)

Top listed global companies in the industry are:

Providence Photonics, LLC., ABB, Siemens AG, AMETEK.Inc., LumaSense Technologies, Inc., Williamson Corporation, Thermo Fisher Scientific Inc., Extrel CMS, LLC, FLIR Systems Inc., Honeywell International Inc., Fluenta AS., and Zeeco, Inc.