Economic Incentives and Cost Savings

The Flare Gas Recovery System Market is also driven by the economic incentives associated with the implementation of recovery systems. Companies are increasingly recognizing that capturing and utilizing flare gas can lead to substantial cost savings. By converting waste gas into usable energy, firms can reduce their reliance on purchased fuels, thereby lowering operational costs. Furthermore, the potential for monetizing recovered gas adds an additional revenue stream. Recent analyses indicate that companies can achieve payback periods of less than three years on their investments in flare gas recovery systems. This financial viability is particularly appealing in a market where profit margins are under pressure, making the adoption of recovery systems not only an environmentally responsible choice but also a financially prudent one.

Regulatory Compliance and Emission Standards

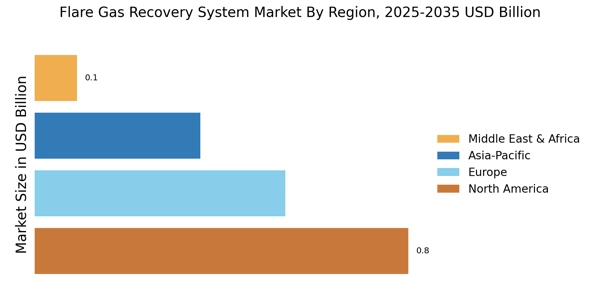

The Flare Gas Recovery System Market is increasingly influenced by stringent regulatory frameworks aimed at reducing greenhouse gas emissions. Governments worldwide are implementing policies that mandate the reduction of flaring activities, which has historically contributed to environmental degradation. For instance, regulations in regions such as North America and Europe have set ambitious targets for emission reductions, compelling oil and gas companies to adopt flare gas recovery systems. This shift not only aligns with environmental goals but also enhances operational efficiency. As a result, the market for flare gas recovery systems is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. Companies that proactively invest in compliance technologies are likely to gain a competitive edge in this evolving landscape.

Technological Innovations in Recovery Systems

Technological advancements play a pivotal role in shaping the Flare Gas Recovery System Market. Innovations in recovery technologies, such as improved separation processes and enhanced gas compression techniques, are making flare gas recovery more efficient and cost-effective. These advancements enable companies to capture a higher percentage of flare gas, thus maximizing recovery rates. Additionally, the integration of digital technologies, such as IoT and data analytics, allows for real-time monitoring and optimization of recovery systems. As these technologies continue to evolve, they are expected to drive further adoption of flare gas recovery systems, with market analysts projecting a significant increase in system efficiency and reliability. This trend indicates a promising future for the industry, as companies seek to leverage cutting-edge technologies to enhance their operational capabilities.

Rising Energy Demand and Resource Optimization

The Flare Gas Recovery System Market is also driven by the increasing global demand for energy and the need for resource optimization. As populations grow and economies expand, the pressure on energy resources intensifies. Flare gas, often viewed as a waste product, represents a significant untapped resource that can be harnessed to meet energy needs. By implementing flare gas recovery systems, companies can convert this waste into a valuable energy source, thereby contributing to energy security. Recent studies suggest that recovering flare gas could potentially supply energy equivalent to millions of barrels of oil annually. This potential for resource optimization aligns with the broader goals of energy efficiency and sustainability, making the adoption of flare gas recovery systems a strategic imperative for companies aiming to thrive in an increasingly resource-constrained environment.

Corporate Social Responsibility and Public Image

The Flare Gas Recovery System Market is increasingly influenced by the growing emphasis on corporate social responsibility (CSR) among energy companies. Stakeholders, including investors and consumers, are placing greater importance on environmental stewardship and sustainable practices. Companies that adopt flare gas recovery systems can significantly improve their public image by demonstrating a commitment to reducing their carbon footprint. This positive perception can lead to enhanced brand loyalty and customer trust, which are crucial in a competitive market. Furthermore, organizations that prioritize sustainability are often better positioned to attract investment, as socially responsible investing continues to gain traction. As a result, the integration of flare gas recovery systems is not merely a regulatory compliance measure but a strategic initiative that can bolster a company's reputation and market position.