Market Growth Projections

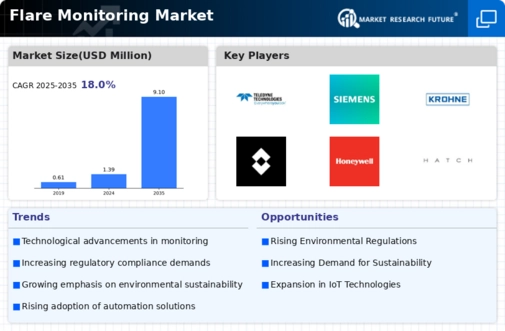

The Global Flare Monitoring Market Industry is poised for substantial growth, with projections indicating an increase from 1.39 USD Billion in 2024 to 9.1 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 18.64% from 2025 to 2035, driven by various factors including regulatory compliance, technological advancements, and increasing production activities. The market's expansion is indicative of the rising importance of flare monitoring solutions in the oil and gas sector, as companies strive to balance production efficiency with environmental stewardship.

Investment in Renewable Energy Sources

The transition towards renewable energy sources is indirectly impacting the Global Flare Monitoring Market Industry. As countries invest in renewable energy, there is a concurrent need to manage and monitor the flaring of natural gas that often accompanies oil extraction. This dual focus on renewable energy and flare management creates a unique market opportunity for monitoring solutions that can address both concerns. Companies are likely to seek technologies that facilitate the efficient use of resources while minimizing waste. This trend may lead to increased investments in flare monitoring systems, further propelling market growth.

Growing Awareness of Environmental Impact

There is a growing awareness of the environmental impact of flaring activities, which is influencing the Global Flare Monitoring Market Industry. Stakeholders, including governments, NGOs, and the public, are increasingly advocating for reduced flaring and improved monitoring practices. This awareness is prompting companies to invest in flare monitoring technologies to mitigate their environmental impact and enhance their corporate social responsibility profiles. As a result, the demand for advanced monitoring solutions is likely to increase, driving market growth. The industry's expansion is further supported by the anticipated increase in regulatory pressures aimed at curbing emissions.

Increasing Oil and Gas Production Activities

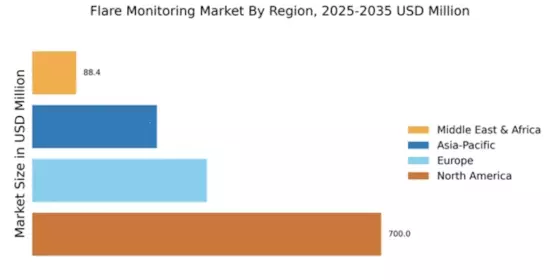

The Global Flare Monitoring Market Industry is closely linked to the rising oil and gas production activities across various regions. As exploration and extraction efforts expand, the associated flaring of natural gas increases, necessitating effective monitoring solutions. Countries with significant oil reserves, such as the United States and those in the Middle East, are particularly focused on implementing flare monitoring systems to manage emissions. This trend is expected to contribute to the market's growth, as operators seek to optimize production while adhering to environmental regulations. The projected growth from 1.39 USD Billion in 2024 to 9.1 USD Billion by 2035 underscores the industry's response to these production dynamics.

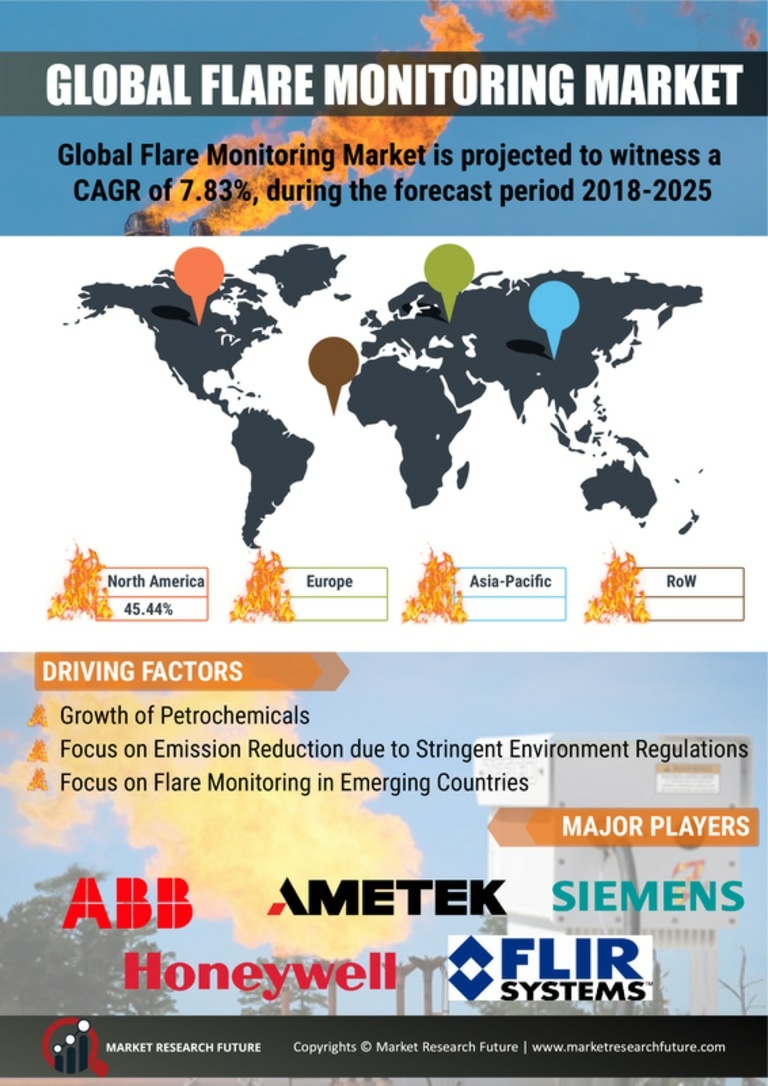

Regulatory Compliance and Environmental Standards

The Global Flare Monitoring Market Industry is experiencing heightened demand due to stringent regulatory compliance and environmental standards imposed by governments worldwide. Regulations aimed at reducing greenhouse gas emissions and flaring activities necessitate advanced monitoring solutions. For instance, the U.S. Environmental Protection Agency has set forth guidelines that require oil and gas operators to monitor and report flare emissions. This regulatory landscape is expected to drive the market significantly, as companies seek to adhere to these standards while minimizing their environmental footprint. As a result, the industry is projected to grow from 1.39 USD Billion in 2024 to an estimated 9.1 USD Billion by 2035, reflecting a robust CAGR of 18.64% from 2025 to 2035.

Technological Advancements in Monitoring Solutions

Innovations in technology are propelling the Global Flare Monitoring Market Industry forward, with advancements in remote sensing, satellite monitoring, and real-time data analytics. These technologies enhance the accuracy and efficiency of flare monitoring systems, enabling operators to detect and quantify emissions more effectively. For example, the integration of IoT devices allows for continuous monitoring and immediate reporting, which is crucial for compliance and operational efficiency. As industries increasingly adopt these advanced solutions, the market is likely to witness substantial growth, driven by the need for precise monitoring and reporting capabilities.