Leading market players are investing capital and resources across research and development to extend their product offerings, this is expected to help the Asia Pacific Blood Glucose Monitoring Market, grow even more. Market leaders and manufacturers are also adopting various strategies to expand their worldwide footprint, with important market developments including new product developments & launches, contracts & agreements, mergers & acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Asia Pacific Blood Glucose Monitoring industry must offer cost-effective items.

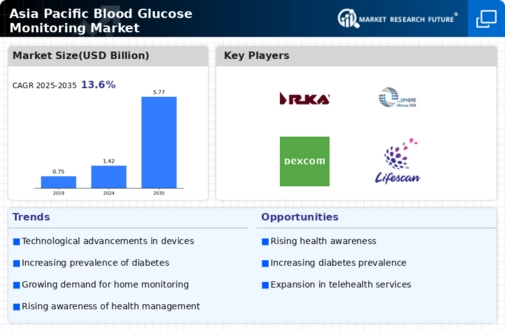

The manufacturers are making use of locally available resources to minimize the production costs which will aid the growth of the Asia Pacific Blood Glucose Monitoring industry to benefit clients and increase the market sector. In recent years, the Asia Pacific Blood Glucose Monitoring industry has offered some of the most significant advantages to medicine. Major players in the Asia Pacific Blood Glucose Monitoring Market, including Abbott Laboratories, Arkay Inc., Bayer Healthcare AG, F. Hoffmann-La Roche, Goldsite Diagnostics Inc., GlySure Ltd., Sphere Medical, Dexcom, LifeScan, and others, are attempting to increase market demand by investing in research and development operations.

Continuous glucose monitoring (CGM) systems are created, developed, and sold by Dexcom Inc. (Dexcom) for use by patients with diabetes and medical professionals in hospitals. Integrated Dexcom G6 CGM system, Dexcom Share remote monitoring system, Dexcom Real-Time API, Dexcom ONE CGM system, related software, and mobile apps are some of the company's main products. It also offers various support services including Dexcom Care training to CGM system customers. Endocrinologists, physicians, diabetes educators, and others can purchase products from the business.

In addition to using a network of distributors in Australia, the US, New Zealand, and other nations in Asia, Europe, Africa, Latin America, and the Middle East, it distributes items directly in the US, Austria, Canada, Germany, Switzerland, and the UK. In the US, San Diego, California, is home to the Dexcom headquarters.

In July A Type 2 diabetes monitor with a 15-day sensor and a cash-pay option for patients who are not covered by Medicare and health insurers but want daily decision support is being developed by Dexcom, a manufacturer of continuous glucose monitors.

A wide variety of healthcare goods are discovered, developed, produced, and sold by Abbott Laboratories (Abbott), including branded generic medications, diagnostic tools and procedures, and infant, child, and adult nutritional supplements. The business also sells a range of medical devices, such as those for neuromodulation, electrophysiology, rhythm control, vascular and structural cardiac devices, and heart failure. The business also sells dietary supplements, minerals, and nutrition goods. It runs manufacturing sites all around the world and has research and development centers in the US, China, Colombia, India, Singapore, Spain, and the UK.

The corporation sells its goods across Africa, the Middle East, Latin America, North America, and the Asia-Pacific region.

In June Abbott disclosed that it is developing a cutting-edge wearable with a sensor for continuous glucose and ketone monitoring.

The system has been given the breakthrough device classification by the U.S. Food and Drug Administration, which is meant to expedite the review of cutting-edge technology that potentially improve the lives of patients with fatal or permanently debilitating diseases or conditions.