Q2 2025: CATL to Open New $2 Billion Battery Market Plant in Hungary Contemporary Amperex Technology Co. Ltd. (CATL) announced the opening of a new $2 billion battery manufacturing facility in Debrecen, Hungary, aimed at supplying European automakers with lithium-ion batteries.

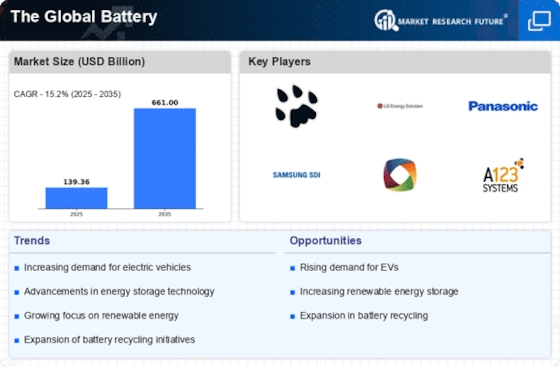

Q2 2025: Panasonic Energy and Mazda Announce EV Battery Market Partnership Panasonic Energy and Mazda entered into a strategic partnership to supply cylindrical lithium-ion batteries for Mazda’s next-generation electric vehicles, with production set to begin in 2026.

Q2 2025: Northvolt Raises $1.2 Billion to Expand Battery Market Production in Europe Swedish battery maker Northvolt secured $1.2 billion in new funding to accelerate the expansion of its European gigafactories, supporting growing demand from the automotive and energy storage sectors.

Q2 2025: General Motors and POSCO Future M Open Battery Market Materials Plant in Canada General Motors and POSCO Future M officially opened a new battery materials facility in Quebec, Canada, to produce cathode active materials for GM’s Ultium batteries.

Q1 2025: Redwood Materials Secures $500 Million in Series D Funding Battery Market recycling startup Redwood Materials raised $500 million in a Series D funding round to expand its recycling operations and build a new facility in the United States.

Q1 2025: BYD Launches New Sodium-Ion Battery Market for Electric Vehicles Chinese automaker BYD unveiled its first sodium-ion battery for electric vehicles, marking a significant step toward diversifying battery chemistries and reducing reliance on lithium.

Q1 2025: SK On Signs $3 Billion Battery Market Supply Deal with Ford South Korea’s SK On signed a $3 billion multi-year contract to supply batteries for Ford’s next generation of electric vehicles in North America.

Q4 2024: Tesla Appoints New Head of Battery Market Engineering Tesla announced the appointment of Dr. Maria Chen as Senior Vice President of Battery Market Engineering, overseeing the company’s global battery technology and manufacturing strategy.

Q4 2024: LG Energy Solution and Honda Open Joint Battery Market Plant in Ohio LG Energy Solution and Honda inaugurated their joint $4.4 billion battery manufacturing facility in Ohio, which will supply batteries for Honda and Acura electric vehicles in North America.

Q4 2024: QuantumScape Receives Regulatory Approval for Solid-State Battery Market Pilot Line QuantumScape received regulatory approval to begin operations at its solid-state battery pilot manufacturing line in California, a key milestone toward commercializing next-generation batteries.

Q3 2024: Samsung SDI and Stellantis Announce $2.5 Billion Battery Market Plant in Indiana Samsung SDI and Stellantis broke ground on a $2.5 billion battery manufacturing plant in Indiana, expected to supply batteries for Stellantis’ electric vehicles in the U.S. market.

Q3 2024: CATL Signs Long-Term Battery Market Supply Agreement with BMW CATL announced a long-term agreement to supply BMW with lithium-ion batteries for its upcoming electric vehicle models, strengthening their existing partnership.