Expansion of Delivery Services

The Fixed Wing Drone Market is witnessing a transformative shift with the expansion of delivery services. Companies are increasingly exploring the use of fixed wing drones for logistics and parcel delivery, particularly in remote or hard-to-reach areas. The efficiency of fixed wing drones, which can cover greater distances at higher speeds, positions them as a viable solution for last-mile delivery challenges. Recent studies indicate that the drone delivery market could reach a valuation of over 29 billion dollars by 2030, highlighting the potential for fixed wing drones in this sector. As businesses seek to optimize their supply chains and reduce delivery times, the Fixed Wing Drone Market is likely to benefit from this trend, fostering innovation and investment in drone technology.

Rising Environmental Awareness

The Fixed Wing Drone Market is increasingly influenced by rising environmental awareness and sustainability initiatives. Organizations are utilizing fixed wing drones for environmental monitoring, wildlife conservation, and disaster management. These drones provide critical data for assessing environmental changes and managing natural resources effectively. The market for environmental drones is projected to grow significantly, with estimates suggesting a potential market size of over 5 billion dollars by 2027. As stakeholders prioritize sustainability and environmental protection, the demand for fixed wing drones in these applications is likely to increase. This trend not only supports the Fixed Wing Drone Market but also aligns with broader global efforts to address environmental challenges.

Advancements in Drone Technology

Technological advancements play a crucial role in shaping the Fixed Wing Drone Market. Innovations in materials, battery life, and navigation systems enhance the performance and capabilities of fixed wing drones. For instance, the integration of artificial intelligence and machine learning algorithms allows for improved autonomous flight and data processing. These advancements not only increase operational efficiency but also expand the range of applications for fixed wing drones, from mapping and surveying to search and rescue operations. The market is expected to see a significant uptick in investment as companies strive to leverage these technologies, potentially leading to a market size exceeding 10 billion dollars by 2026. As technology continues to evolve, the Fixed Wing Drone Market is poised for substantial growth.

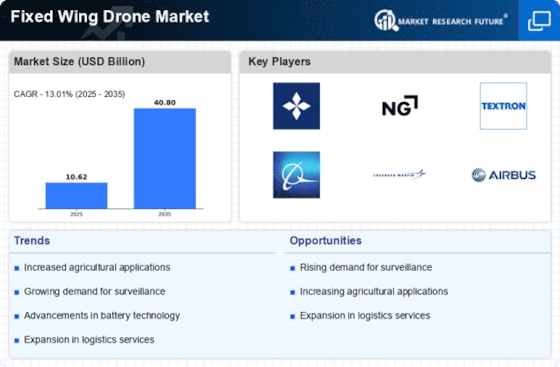

Growing Demand for Surveillance and Monitoring

The Fixed Wing Drone Market experiences a notable surge in demand for surveillance and monitoring applications. Various sectors, including agriculture, environmental monitoring, and security, increasingly rely on fixed wing drones for their ability to cover large areas efficiently. The market is projected to grow at a compound annual growth rate of approximately 15% over the next five years, driven by the need for real-time data collection and analysis. Fixed wing drones offer extended flight times and greater payload capacities compared to their rotary counterparts, making them particularly suitable for long-range missions. This growing demand for surveillance capabilities is likely to propel the Fixed Wing Drone Market forward, as organizations seek to enhance their operational efficiency and decision-making processes.

Increased Investment in Infrastructure Development

The Fixed Wing Drone Market is likely to benefit from increased investment in infrastructure development across various sectors. Governments and private entities are recognizing the value of drones for infrastructure inspection, maintenance, and monitoring. Fixed wing drones can efficiently survey large areas, making them ideal for assessing roads, bridges, and power lines. Recent reports suggest that the infrastructure sector is expected to see investments exceeding 3 trillion dollars in the coming years, creating a fertile ground for the adoption of fixed wing drones. This trend indicates a growing recognition of the cost-effectiveness and efficiency that drones bring to infrastructure projects, thereby driving the Fixed Wing Drone Market forward.