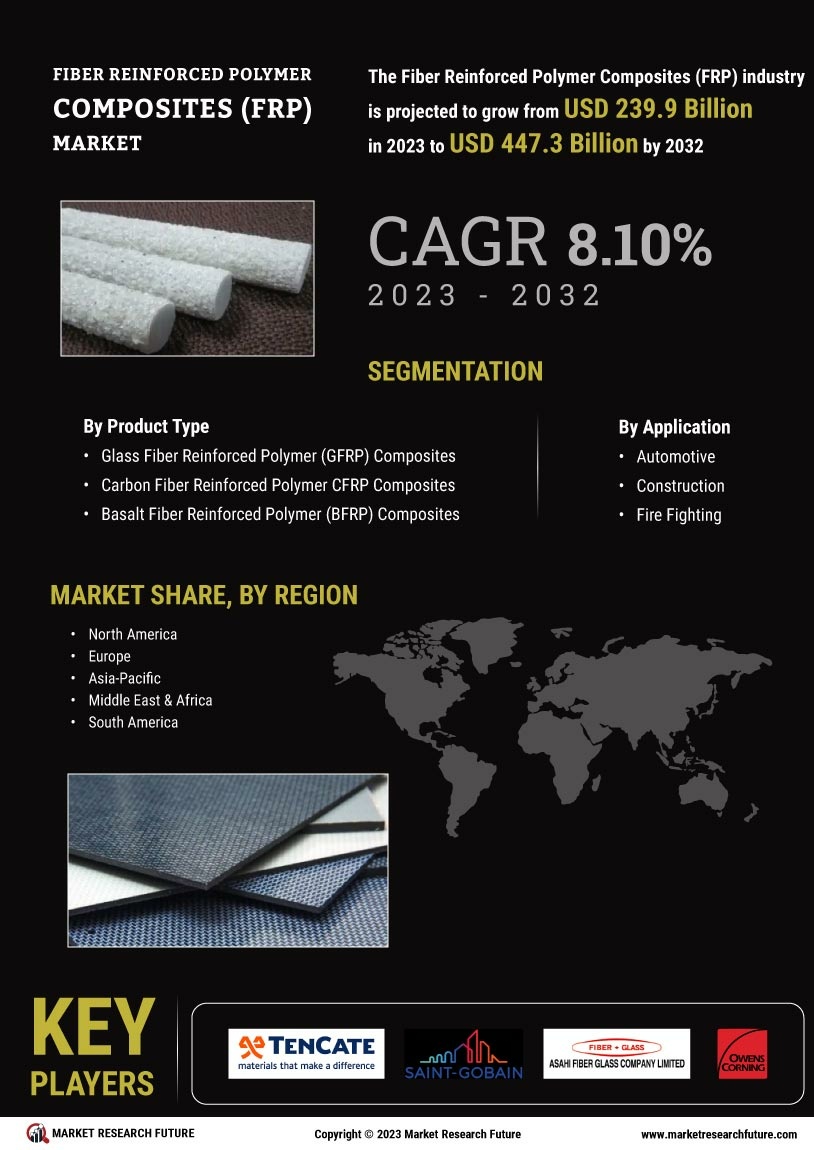

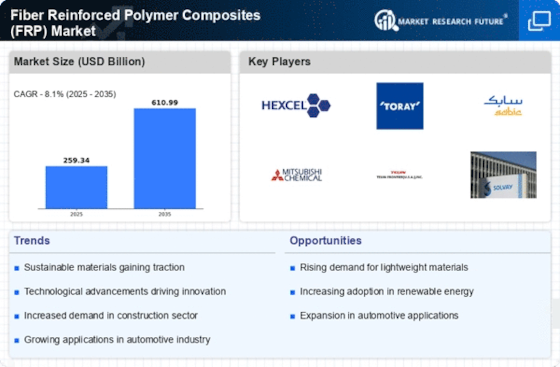

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Fiber Reinforced Polymer Composites Market (FRP) market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Fiber Reinforced Polymer Composites Market (FRP) industry must offer cost-effective items.Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Fiber Reinforced Polymer Composites Market (FRP) industry to benefit clients and increase the market sector. In recent years, the Fiber Reinforced Polymer Composites Market (FRP) industry has offered some of the most significant advantages to medicine.Major players in the Fiber Reinforced Polymer Composites Market (FRP) market, including Ten Cate NV, Saint Gobain, Asahi Fiberglass, Owen Corning, Mitsubishi Rayon Co., Ltd, B&B FRP Manufacturing Inc., American Fiberglass Rebar, and American Grating, LLC, are attempting to increase market demand by investing in research and development Product Types.Owens Corning creates systems for composite and building materials. The business manufactures and sells fiberglass composites. Its product line includes loose-fill insulation, foam sheathing, thermal and acoustical batts, and accessories. The company also offers oxidized asphalt, laminated and strip asphalt roofing shingles, and synthetic packaging materials. The company offers its products under a variety of brand names, such as PINK FIBERGLAS, FOAMGLAS, Paroc, and FOAMULAR. Among the industries that Owens Corning serves include residential, commercial, industrial, defense, automotive, transportation, power, and energy. The company conducts business in the regions of North America, South and Central America, Asia-Pacific, and Europe.The headquarters of Owens Corning are in Toledo, Ohio, in the United States.

In July Owens Corning Infrastructure Solutions acquired Aslan FRP, a manufacturer of composite rebars used in the building of roads, bridges, maritime structures, tunnels, and other structures.Compagnie de Saint-Gobain (Saint-Gobain) manufactures building materials and construction-related products. Its product line comprises a range of plastics, pipelines and associated goods, building supplies, gypsum, industrial mortar, roofing, and exterior wall products. Additionally, the business sells performance polymers, glass textiles, and mineral ceramics. These products are marketed by the company under a number of names, including ADFORS, British Gypsum, Saint-Gobain Gla, and Isover. The automotive, aerospace, health, defense, energy, security, and food and beverage industries all use Saint-Gobain products. Along with its affiliates and subsidiaries, the corporation conducts business throughout the Americas, Europe, the Middle East, Africa, and Asia-Pacific.The headquarters of Saint-Gobain are located in Courbevoie, Ile-de-France, France. Saint Gobain Sekurit and Corning Incorporated formed a joint venture in January 2016 to develop, produce, and market lightweight glazing solutions for the automotive industry, including Corning, Gorilla, and other enhanced options.