Growing Demand in Construction Sector

The construction sector is increasingly recognizing the benefits of aramid fiber reinforced polymers, particularly in applications requiring high durability and resistance to environmental factors. The Aramid Fiber Reinforced Polymer Market is likely to see growth as these materials are utilized in infrastructure projects, such as bridges and buildings, where strength and longevity are paramount. Recent studies indicate that the construction industry is projected to invest heavily in advanced composite materials, with aramid fibers being a key component. This trend suggests a promising future for the market, as construction firms seek innovative solutions to enhance structural integrity and reduce maintenance costs.

Increasing Demand in Aerospace Sector

The aerospace sector exhibits a growing demand for lightweight and high-strength materials, which positions the Aramid Fiber Reinforced Polymer Market favorably. As aircraft manufacturers seek to enhance fuel efficiency and reduce emissions, the use of aramid fiber reinforced polymers becomes increasingly attractive. These materials offer superior mechanical properties, making them ideal for structural components in aircraft. According to industry reports, the aerospace segment is projected to account for a substantial share of the aramid fiber reinforced polymer market, driven by the need for advanced composites that can withstand extreme conditions. This trend indicates a robust growth trajectory for the market, as investments in aerospace technology continue to rise.

Regulatory Support for Advanced Materials

Regulatory frameworks are increasingly favoring the use of advanced materials, including aramid fiber reinforced polymers, across various industries. The Aramid Fiber Reinforced Polymer Market stands to gain from policies promoting the adoption of lightweight and high-performance materials. Governments are implementing standards that encourage the use of composites in sectors such as aerospace, automotive, and construction, driven by the need for improved safety and environmental performance. This regulatory support is likely to stimulate market growth, as companies align their product offerings with these evolving standards, thereby enhancing their competitive edge in the marketplace.

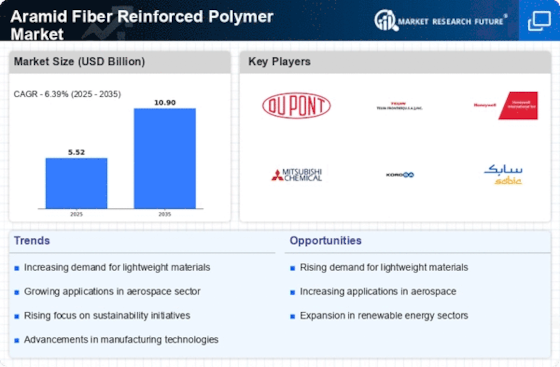

Advancements in Manufacturing Technologies

Technological advancements in manufacturing processes are significantly impacting the Aramid Fiber Reinforced Polymer Market. Innovations such as automated fiber placement and advanced resin infusion techniques are enhancing the efficiency and quality of aramid fiber composites. These advancements not only reduce production costs but also improve the mechanical properties of the final products. As manufacturers adopt these cutting-edge technologies, the market is expected to expand, with increased production capabilities and reduced lead times. The integration of smart manufacturing practices may also lead to more sustainable production methods, aligning with the growing emphasis on environmental responsibility within the industry.

Rising Adoption in Automotive Applications

The automotive industry is witnessing a notable shift towards the adoption of lightweight materials to improve fuel efficiency and performance. The Aramid Fiber Reinforced Polymer Market is poised to benefit from this trend, as manufacturers increasingly incorporate aramid fibers into vehicle components. These materials provide enhanced strength-to-weight ratios, contributing to overall vehicle performance. Recent data suggests that the automotive sector is expected to experience a compound annual growth rate (CAGR) of over 10% in the use of aramid fiber reinforced polymers. This growth is likely fueled by stringent regulations aimed at reducing carbon emissions, further solidifying the market's position in automotive applications.