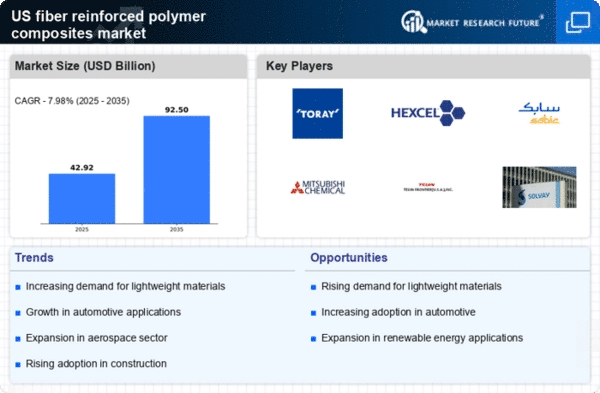

The fiber reinforced-polymer-composites market is currently characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as automotive, aerospace, and construction. Key players are actively pursuing strategies that emphasize innovation, sustainability, and regional expansion. For instance, Toray Industries (Japan) has been focusing on enhancing its product portfolio through advanced research and development initiatives, while Hexcel Corporation (US) is leveraging its strong position in aerospace composites to expand into emerging markets. These strategic orientations not only bolster their market presence but also contribute to a more competitive environment, as companies strive to differentiate themselves through technological advancements and customer-centric solutions.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. This approach appears to be particularly effective in a moderately fragmented market, where the collective influence of key players shapes pricing strategies and product availability. The competitive structure is evolving, with larger firms like SABIC (Saudi Arabia) and BASF SE (Germany) seeking to consolidate their positions through strategic partnerships and acquisitions, thereby enhancing their operational efficiencies and market reach.

In September SABIC (Saudi Arabia) announced a collaboration with a leading automotive manufacturer to develop lightweight composite materials aimed at improving fuel efficiency. This partnership underscores the growing trend towards sustainability in the automotive sector, as companies seek to meet stringent environmental regulations while enhancing performance. The strategic importance of this move lies in SABIC's ability to leverage its expertise in polymer technology to create innovative solutions that address both market demands and regulatory challenges.

In October 3M Company (US) unveiled a new line of fiber reinforced composites designed for use in high-performance applications. This launch reflects 3M's commitment to innovation and its strategic focus on diversifying its product offerings. By introducing advanced materials that cater to specific industry needs, 3M positions itself as a leader in the market, potentially capturing a larger share of the growing demand for specialized composites.Moreover, in August 2025, Mitsubishi Chemical Corporation (Japan) expanded its production capacity for fiber reinforced composites in North America. This strategic move is indicative of the company's intent to strengthen its foothold in a key market, responding to the increasing demand for lightweight materials in various applications. The expansion not only enhances Mitsubishi's operational capabilities but also signals a broader trend of companies investing in local production to better serve their customers.

As of November the competitive trends in the fiber reinforced-polymer-composites market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence in manufacturing processes. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing supply chain reliability. Looking ahead, it is likely that competitive differentiation will evolve from traditional price-based competition to a focus on technological advancements and sustainable practices, as firms strive to meet the changing expectations of consumers and regulatory bodies.