Growing Demand in Construction Sector

The Global Ferric Oxide Market Industry is experiencing a notable surge in demand driven by the construction sector. Ferric oxide is extensively utilized in cement and concrete applications, where it serves as a pigment and enhances durability. In 2024, the market is projected to reach 1.86 USD Billion, reflecting the increasing investments in infrastructure development worldwide. Countries such as India and China are ramping up construction activities, which further propels the demand for ferric oxide. This trend indicates a robust growth trajectory, as the construction sector is expected to remain a primary consumer of ferric oxide, contributing significantly to the overall market expansion.

Technological Advancements in Production

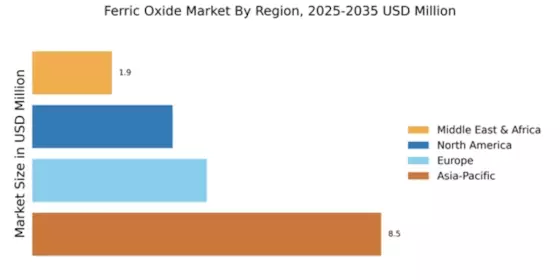

Innovations in production technologies are poised to drive the Global Ferric Oxide Market Industry forward. Enhanced manufacturing processes, such as the development of more efficient synthesis methods, are likely to reduce costs and improve product quality. These advancements may lead to increased production capacities and a wider range of ferric oxide products tailored for specific applications. As companies adopt these technologies, the market could witness a shift towards higher purity and specialty ferric oxides, catering to niche markets. This trend may contribute to the overall growth of the industry, aligning with the projected CAGR of 4.69% from 2025 to 2035.

Rising Applications in Paints and Coatings

The Global Ferric Oxide Market Industry is significantly influenced by its applications in the paints and coatings sector. Ferric oxide pigments are favored for their excellent color stability and UV resistance, making them ideal for various coatings. As the global demand for high-quality paints increases, particularly in automotive and industrial applications, the market for ferric oxide is likely to expand. The anticipated growth in the paints and coatings industry suggests a favorable environment for ferric oxide, with projections indicating a market value of 3.08 USD Billion by 2035. This growth is indicative of the material's versatility and essential role in enhancing product performance.

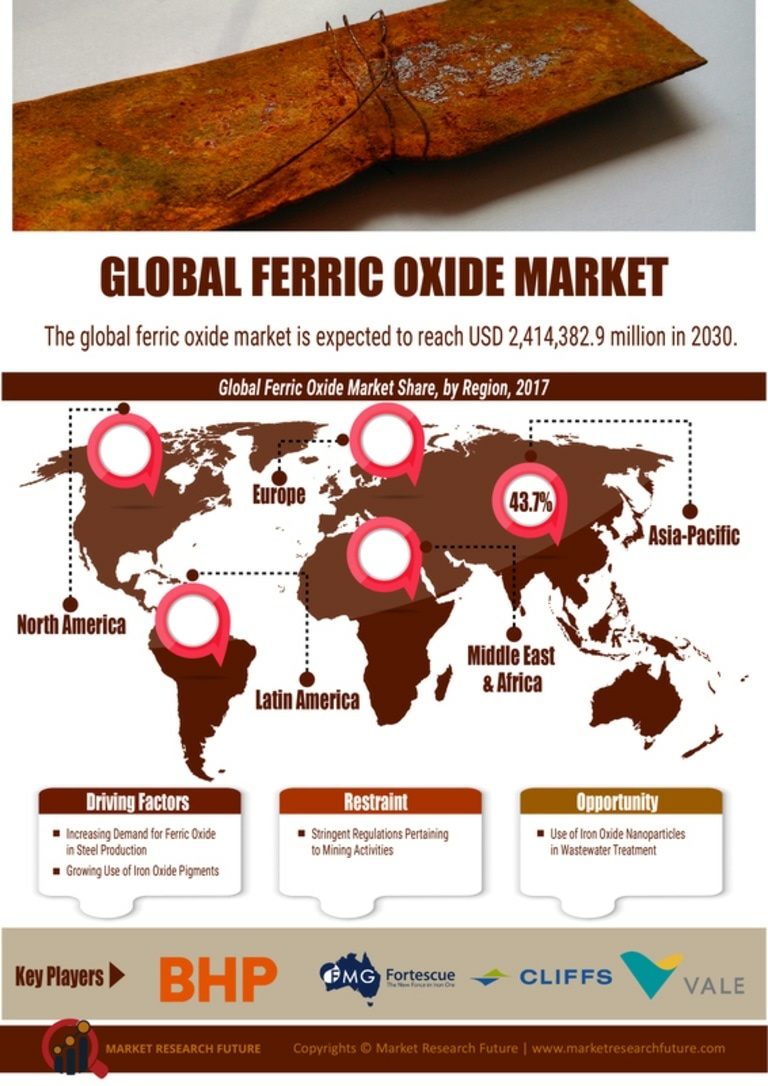

Market Diversification and Global Expansion

The Global Ferric Oxide Market Industry is witnessing diversification as manufacturers explore new geographical markets and applications. Emerging economies in Asia-Pacific and Latin America are becoming focal points for expansion, driven by industrialization and urbanization. This diversification is likely to create new opportunities for ferric oxide producers, as they adapt their offerings to meet regional demands. The growth in these markets could significantly contribute to the industry's overall expansion, aligning with the projected market value of 3.08 USD Billion by 2035. As companies navigate these new landscapes, the potential for increased sales and market penetration appears promising.

Environmental Regulations Favoring Natural Pigments

The Global Ferric Oxide Market Industry is benefiting from stringent environmental regulations that favor the use of natural pigments over synthetic alternatives. Ferric oxide, being a naturally occurring mineral, aligns with the growing consumer preference for eco-friendly products. As industries strive to comply with environmental standards, the demand for ferric oxide is expected to rise, particularly in sectors such as cosmetics and food. This shift towards sustainable practices could enhance the market's growth prospects, as manufacturers increasingly seek to incorporate ferric oxide into their formulations, thereby expanding its applications and market reach.