Research Methodology on Feed Flavors and Sweeteners Market

1. Introduction:

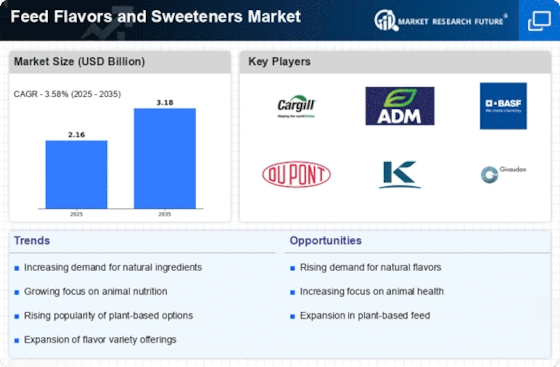

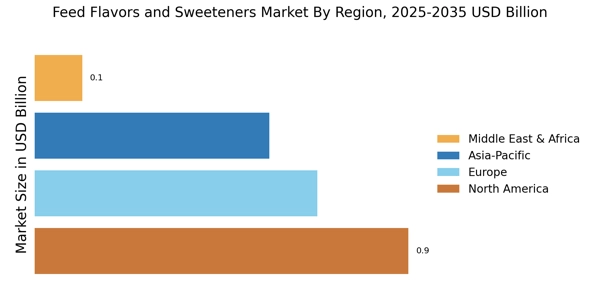

Feed Flavors and Sweeteners Market report studies the global market size of Feed Flavors and Sweeteners in key regions like North America, Europe, Asia-Pacific, Central & South America and Middle East & Africa, focuses on the consumption of Feed Flavors and Sweeteners in these regions. This research report categorizes the global Feed Flavors and Sweeteners market by top players/brands, type, application and end users.

This report also studies the global Feed Flavors and Sweeteners market status, competition landscape, market share, growth rate, future trends, market drivers, opportunities and challenges, sales channels and distributors.

2. Research Methodology:

The research methodology used for the Feed Flavors and Sweeteners Market is multi-dimensional focusing on extracting information from different sources such as market participants, organization analysts, industry experts, policymakers, industry journals, and research papers.

The research process included a combination of primary and secondary research processes to gain data points from various sources. The primary information was collected from interviews and surveys with leading market participants, including market vendors and suppliers. Secondary sources included data gathered from research publications, industry magazines, business journals, white papers, books, and other online sources.

2.1. Secondary Research:

Secondary research was conducted to gain an in-depth understanding of the Feed Flavors and Sweeteners market and global supply/demand dynamics. The secondary sources selected for the secondary research process include financial reports, industry magazines, company presentations, governmental databases, and secondary databases. The data collected from these sources was curated and collated to gain a better understanding of the Feed Flavors and Sweeteners market.

2.2. Primary Research:

The primary research process included a detailed study of market participants across the value chain, involving interviews with market leaders and market vendors across the industry. Primary research enabled us to understand the market dynamics and market drivers of the Feed Flavors and Sweeteners market.

The primary research process also included face-to-face interviews with leading industry personnel to gain valuable insights into the market. The primary research process further included gathering data from past and current Feed Flavors and Sweeteners market participants, industry experts, and decision-makers.

2.3. Bottom-Up Approach:

The bottom-up approach is a method used to determine the market size of the global Feed Flavors and Sweeteners Market by analyzing data at the regional level. This data is then aggregated to calculate the market size of the Feed Flavors and Sweeteners Market.

Data collected from the interviews and surveys conducted as part of primary research is used to arrive at a bottom-up approach for the market size calculation. The use of the bottom-up approach enabled us to gather information from different sources and arrive at the total market size of the industry.

2.4. Top-Down Approach:

The top-down approach was used to validate the data points collected through the bottom-up approach. The top-down approach included the integration of the bottom-up approach with the industry data made available by the prominent market participants in the Feed Flavors and Sweeteners Market.

The top-down approach also helps validate the accuracy of the collected data points through various sources and evaluates the impact of technological advancements, trends, and regulatory policies on the industry.

2.5. Factor Analysis:

The factor analysis method is used to analyze the factors affecting the market growth and the trends impacting the industry. The factor analysis methodology evaluates the demand and supply side factors to gain an in-depth understanding of the changes occurring in the industry.

The analysis of the market factors helps to understand the market dynamics and the current market scenario. The factor analysis also helps to identify the market opportunities for the Feed Flavors and Sweeteners market and to gain an understanding of the impact of changes in the industry.

2.6. Time-Series Analysis:

Time-series analysis is used to analyze the trends and patterns in the Feed Flavors and Sweeteners market over time, helping to identify the keywords and latent patterns in the market that may have been missed in the primary and secondary research process. The data collected for time-series analysis is sourced from market reports, industry journals, trade data, government sources, and other market periodicals.

Time-series analysis helps to gain a better understanding of the market dynamics, such as the market drivers, restraints, opportunities, and challenges that the industry is facing during the forecast period 2023 to 2030.

2.7. Demand-Side and Supply-Side Data Triangulation:

Demand-side and supply-side data triangulation is a method used to validate the market size of the Feed Flavors and Sweeteners market. The demand-side triangulation includes analyzing the data from market participants, surveys, interviews, and end-use decisions.

The supply-side triangulation involves sourcing data from supply chain management and market value chain participants. The supply-side triangulation method eliminates discrepancies in the market data points from both sides, helping gain a deeper understanding of the Feed Flavors and Sweeteners market.

3. Conclusion:

The research methodology used for the Feed Flavors and Sweeteners Market report was conducted with a combination of primary and secondary research processes. The data gathered from the research process was collated and curated to gain a better understanding of the Feed Flavors and Sweeteners market. The research process included a bottom-up approach, top-down approach, factor analysis, time-series analysis, and demand-side and supply-side data triangulation processes. The primary research process involved market participants and market vendors across the different parts of the supply chain. The secondary research process included data gathered from industry magazines, business journals, policymakers, and research papers.

This research methodology helps to provide accurate insights into the Feed Flavors and Sweeteners market, facilitating a comprehensive market understanding and in-depth market analysis. This data can further help to estimate future opportunities and challenges that the market may face during the forecast period 2023 to 2030.