The Sweeteners Market is currently experiencing a dynamic evolution, driven by shifting consumer preferences and increasing health consciousness. As individuals become more aware of the implications of sugar consumption on health, there is a noticeable pivot towards the alternative sweetener market, reflecting demand for reduced-sugar and sugar-free products. This transition is not merely a trend but appears to be a fundamental change in dietary habits, with many seeking to reduce caloric intake while still enjoying sweet flavors. Furthermore, the Sweeteners Market is witnessing innovations across the specialty sweetener market, catering to diabetics and individuals following low-carb diets options. Furthermore, the Sweeteners Market is witnessing innovations across the specialty sweetener market, catering to diabetics and individuals following low-carb diets. In addition to health considerations, the Sweeteners Market is influenced by regulatory changes and advancements in food technology. Manufacturers are increasingly focusing on clean label products, aligning with trends in both the artificial sweeteners market and natural. This shift aligns with consumer desires for authenticity and trust in food sources. As the market continues to evolve, it is essential for stakeholders to remain agile and responsive to these trends, ensuring that offerings align with the changing landscape of consumer expectations and regulatory frameworks. The Sweeteners Market, therefore, stands at a crossroads, where innovation and consumer awareness are likely to shape its future trajectory.

Rise of Natural Sweeteners Market

There is a growing preference for natural sweeteners, such as stevia and monk fruit, as consumers seek healthier alternatives to traditional sugar. This trend supports the expansion of the low intensity sweeteners market, particularly for applications requiring mild sweetness and minimal aftertaste

Focus on Clean Label Products

Manufacturers are increasingly prioritizing clean label products, which emphasize transparency and simplicity in ingredient lists. This approach resonates with consumers who value authenticity and trust in their food choices.

Innovation in Product Formulations

The Sweeteners Market is witnessing innovations aimed at catering to diverse dietary needs, including options for diabetics and those following low-carb diets. This trend indicates a responsiveness to evolving consumer demands.

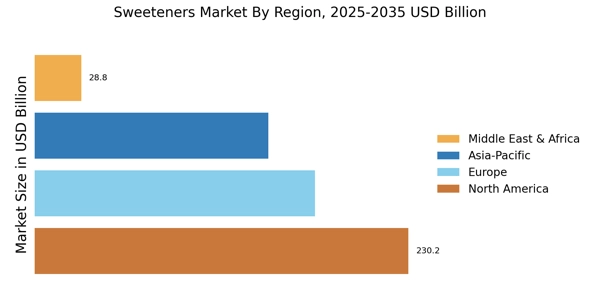

The food sweetener market is experiencing sustained growth driven by increasing demand for sugar alternatives, changing dietary preferences, and rising awareness of health and wellness. This growth spans multiple segments, including the dry sweetener market, which is gaining traction due to ease of storage and longer shelf life. Consumers are actively seeking low-calorie, natural, and clean-label sweetening solutions across beverages, bakery, dairy, and processed food applications. Market analysis indicates that innovation in formulation, expanding use in functional foods, and regulatory support for alternative sweeteners are shaping long-term industry trends and growth potential.