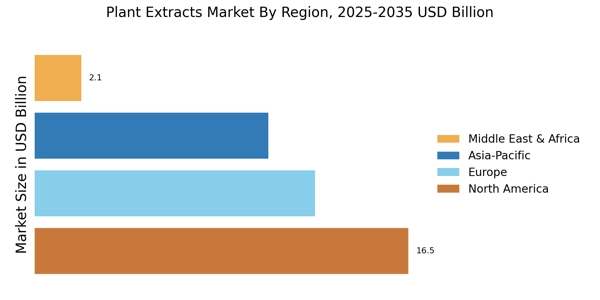

By Region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. North America is an attractive region among the manufacturers of plant extracts. The rising demand for natural ingredients in a variety of foods and beverages is expected to fuel the growth of the plant extracts market in North America. Another major factor driving market growth is product innovation in the food and beverage industry. Consumers are increasingly interested in skincare products made with natural ingredients, which has led to an increase in the use of plant extracts in radiance and anti-cellulite products.

Furthermore, rising demand for herbal medicinal products and supplements is expected to drive growth in the region's plant extracts market. The US Plant Extracts Market is expected to maintain its dominance in the North American plant extracts market, whereas the Canada plant extracts market is the fastest growing during the forecast period.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Type: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Europe Plant Extracts Market held the second-largest market share in 2022 and is expected to be the most profitable regional market during the review period. The increasing consumption of functional beverages, which is particularly high in European countries, is one of the significant factors driving the growth of plant extracts. Customers prefer healthy and nutritious drink alternatives to calorie-laden soft drinks with little or no functional benefits. This shift in preference is the result of a greater emphasis on preventive healthcare and a growing public awareness of health and wellness.

Product development and technological advancements drive the growth of the European functional beverages market during the forecast period. Aside from that, the growing demand for chemical-free cosmetics is encouraging skincare product manufacturers to incorporate plant extracts and other natural ingredients. Further, the Italy Plant Extracts Market held the largest market share, and the Germany Plant Extracts Market was the fastest growing market.

Asia Pacific Plant Extracts Market had the significant revenue share. The plant extracts market in the region is thriving due to high domestic and international demand. Vital Herbs, Alchemy Chemicals, Sydler, and Plantnat are just a few of the small and medium-sized plant extract manufacturers in the region who are aware of the benefits of plant extract manufacturing. Further, the China Plant Extracts Market held the largest market share, and the India Plant Extracts Market was the fastest growing market in the Asia-Pacific region.