Increasing Demand for Cleaner Fuels

The FCC Catalyst and Additives Market is experiencing a notable surge in demand for cleaner fuels, driven by stringent environmental regulations and consumer preferences for sustainable energy sources. As countries implement policies aimed at reducing carbon emissions, refiners are compelled to adopt advanced catalytic processes that enhance fuel quality. This shift is reflected in the growing market for FCC catalysts, which are essential for converting heavy crude oil into lighter, more valuable products. The market for FCC catalysts is projected to reach approximately USD 4 billion by 2026, indicating a robust growth trajectory. This trend underscores the critical role of FCC catalysts in meeting both regulatory requirements and consumer expectations, thereby propelling the FCC Catalyst and Additives Market forward.

Rising Production of Petrochemicals

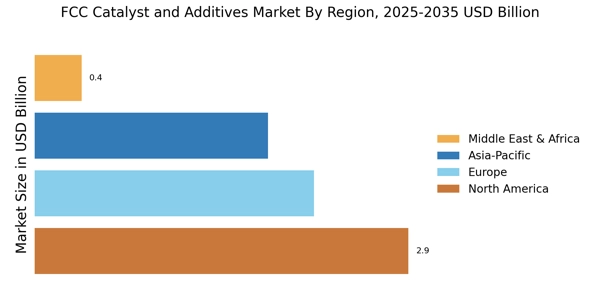

The FCC Catalyst and Additives Market is poised for growth due to the rising production of petrochemicals, which are essential for various industrial applications. As the demand for petrochemical products, such as plastics and synthetic fibers, continues to escalate, refiners are increasingly utilizing FCC processes to convert crude oil into valuable petrochemical feedstocks. This trend is evidenced by the expansion of FCC units in refineries, which are being upgraded to enhance their capacity and efficiency. The FCC Catalyst and Additives is projected to reach USD 1 trillion by 2025, further driving the need for effective FCC catalysts. Consequently, the FCC Catalyst and Additives Market stands to benefit from this upward trajectory in petrochemical production, as refiners seek to optimize their operations and meet market demands.

Shift Towards Renewable Energy Sources

The FCC Catalyst and Additives Market is witnessing a shift towards renewable energy sources, which is reshaping the landscape of fuel production. As the world increasingly embraces renewable energy, refiners are exploring ways to integrate biofuels and other renewable feedstocks into their operations. This transition necessitates the development of specialized FCC catalysts that can efficiently process these alternative feedstocks. The market for biofuels is anticipated to grow significantly, with projections indicating a potential increase in production capacity by over 20% in the coming years. This shift not only presents opportunities for innovation within the FCC Catalyst and Additives Market but also challenges refiners to adapt their processes to accommodate new feedstock types, thereby driving further advancements in catalyst technology.

Technological Innovations in Catalysis

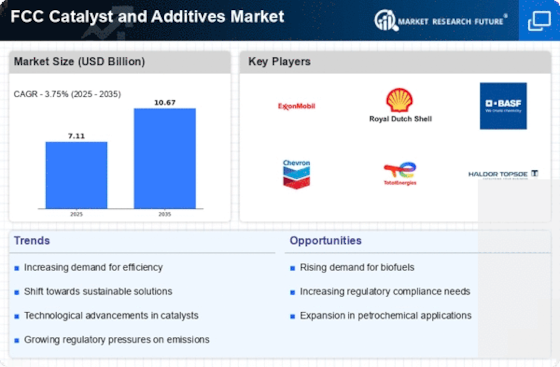

Technological advancements in catalysis are significantly influencing the FCC Catalyst and Additives Market. Innovations such as the development of new catalyst formulations and improved reactor designs are enhancing the efficiency and effectiveness of catalytic processes. These advancements not only optimize the conversion of feedstocks but also reduce operational costs for refiners. For instance, the introduction of zeolite-based catalysts has shown to improve selectivity and yield in the production of high-octane gasoline. As refiners seek to maximize profitability while adhering to environmental standards, the adoption of these cutting-edge technologies is likely to accelerate. The market for FCC catalysts is expected to witness a compound annual growth rate (CAGR) of around 5% over the next few years, driven by these technological innovations.

Regulatory Compliance and Environmental Standards

The FCC Catalyst and Additives Market is significantly influenced by the need for regulatory compliance and adherence to environmental standards. Governments worldwide are implementing stricter regulations aimed at reducing emissions and promoting cleaner production processes. This regulatory landscape compels refiners to invest in advanced FCC catalysts that can help achieve compliance while maintaining operational efficiency. The increasing focus on sustainability is prompting refiners to adopt catalysts that not only enhance product yield but also minimize environmental impact. As a result, the market for FCC catalysts is expected to grow, with refiners prioritizing investments in technologies that align with regulatory requirements. This trend indicates a shift towards more sustainable practices within the FCC Catalyst and Additives Market.