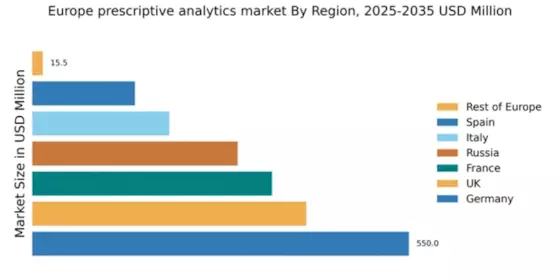

Germany : Strong Growth Driven by Innovation

Germany holds a commanding market share of 550.0, representing approximately 36.5% of the European prescriptive analytics market. Key growth drivers include a robust industrial base, significant investments in AI and machine learning, and a strong focus on data-driven decision-making. Demand trends indicate a rising adoption of analytics solutions across sectors such as manufacturing, finance, and healthcare. Government initiatives promoting digital transformation further bolster this growth, supported by advanced infrastructure and a skilled workforce.

UK : Innovation and Investment Drive Growth

The UK prescriptive analytics market is valued at 400.0, accounting for about 26.5% of the European market. Growth is fueled by a strong emphasis on innovation, particularly in fintech and retail sectors. The demand for real-time analytics is increasing, driven by consumer behavior insights and operational efficiency needs. Regulatory frameworks, such as GDPR, shape data usage policies, while government support for tech startups enhances the analytics ecosystem. The UK's advanced digital infrastructure supports these developments.

France : Diverse Applications Across Industries

France's prescriptive analytics market is valued at 350.0, representing around 23.2% of the European market. Key growth drivers include a focus on enhancing customer experience and operational efficiency across sectors like retail, healthcare, and transportation. The French government promotes digital innovation through various initiatives, fostering a favorable regulatory environment. Demand for analytics solutions is rising, particularly in urban areas like Paris and Lyon, where tech adoption is high.

Russia : Investment in Technology and Infrastructure

Russia's prescriptive analytics market is valued at 300.0, making up about 19.9% of the European market. Growth is driven by increased investments in technology and a push for digital transformation across industries. Demand for analytics is particularly strong in sectors like energy, telecommunications, and finance. Government initiatives aimed at modernizing infrastructure and enhancing data security are pivotal. Key cities like Moscow and St. Petersburg are central to this growth, hosting major tech firms and startups.

Italy : Focus on Manufacturing and Retail Sectors

Italy's prescriptive analytics market is valued at 200.0, representing approximately 13.2% of the European market. Growth is primarily driven by the manufacturing and retail sectors, where analytics solutions enhance operational efficiency and customer insights. The Italian government supports digital initiatives, promoting the adoption of advanced technologies. Key markets include Milan and Turin, where a concentration of industries fosters a competitive landscape with major players like SAP and Oracle.

Spain : Digital Transformation in Key Industries

Spain's prescriptive analytics market is valued at 150.0, accounting for about 9.9% of the European market. The growth is driven by digital transformation initiatives in sectors such as tourism, finance, and retail. Increasing demand for data-driven decision-making is evident, supported by government policies promoting innovation. Major cities like Madrid and Barcelona are at the forefront, hosting numerous tech companies and startups, creating a vibrant competitive landscape.

Rest of Europe : Emerging Markets and Innovations

The Rest of Europe prescriptive analytics market is valued at 15.48, representing a small but growing segment of the overall market. Growth is driven by emerging markets adopting analytics solutions to enhance business operations. Regulatory frameworks vary, but many countries are focusing on digital transformation. Key opportunities exist in sectors like agriculture, logistics, and small to medium enterprises. Countries like Belgium and the Netherlands are notable for their innovative approaches to analytics.