Increased Focus on Operational Efficiency

Organizations are placing a heightened emphasis on operational efficiency, which is driving the adoption of prescriptive analytics solutions. By utilizing these tools, companies can identify inefficiencies, streamline processes, and optimize resource allocation. This focus on efficiency is particularly evident in sectors such as manufacturing and logistics, where even minor improvements can lead to substantial cost savings. The prescriptive analytics market is thus witnessing a growing interest from businesses seeking to enhance their operational performance. As organizations continue to prioritize efficiency, the demand for prescriptive analytics solutions is expected to rise, further propelling market growth.

Regulatory Compliance and Risk Management

The increasing complexity of regulatory requirements is compelling organizations to adopt prescriptive analytics for compliance and risk management. Businesses are utilizing these analytics to assess potential risks, ensure adherence to regulations, and make informed decisions that mitigate liabilities. This trend is particularly pronounced in industries such as finance and healthcare, where compliance is critical. The prescriptive analytics market is likely to benefit from this growing need, as organizations seek to leverage analytics to navigate regulatory landscapes effectively. As compliance becomes more stringent, the demand for prescriptive analytics solutions is expected to grow, driving market expansion.

Emergence of Industry-Specific Applications

The prescriptive analytics market is witnessing the emergence of industry-specific applications tailored to meet the unique needs of various sectors. This trend is driven by the recognition that different industries require specialized analytics solutions to address their distinct challenges. For instance, healthcare organizations are utilizing prescriptive analytics to optimize patient care and resource management, while retail businesses are leveraging these tools for inventory optimization and customer insights. The prescriptive analytics market is thus evolving to offer customized solutions that enhance the effectiveness of analytics across diverse sectors. As the demand for tailored applications increases, the market is expected to expand, catering to the specific requirements of different industries.

Advancements in Cloud Computing Technologies

The rise of cloud computing technologies is significantly impacting the prescriptive analytics market. With the increasing availability of cloud-based solutions, organizations can now access advanced analytics tools without the need for substantial upfront investments in infrastructure. This shift allows for greater scalability and flexibility, enabling businesses to adapt to changing market conditions. Furthermore, cloud platforms facilitate real-time data processing and collaboration, which are critical for effective prescriptive analytics. As a result, the prescriptive analytics market is likely to see accelerated growth as more companies migrate to cloud-based solutions, enhancing their analytical capabilities and driving innovation.

Growing Demand for Data-Driven Decision Making

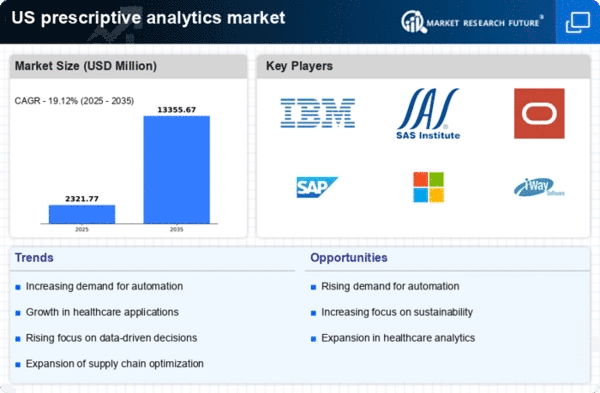

The prescriptive analytics market is experiencing a surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies across various sectors are leveraging analytics to optimize operations, enhance customer experiences, and drive profitability. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is fueled by the need for actionable insights that can guide strategic initiatives. As businesses strive to remain competitive, the adoption of prescriptive analytics tools becomes essential. The prescriptive analytics market is thus positioned to benefit from this trend, as organizations seek to harness data to inform their decisions and improve overall performance.