Focus on Operational Efficiency

The pursuit of operational efficiency is a key driver for the prescriptive analytics market in Japan. Companies are increasingly seeking ways to optimize their operations and reduce costs. By utilizing prescriptive analytics, organizations can identify inefficiencies in their processes and implement data-driven strategies to enhance productivity. This focus on efficiency is particularly pronounced in manufacturing and logistics sectors, where even minor improvements can lead to significant cost savings. As businesses strive to streamline their operations, the prescriptive analytics market is likely to see continued growth, with an expected increase in adoption rates.

Integration of Advanced Technologies

The integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is significantly influencing the prescriptive analytics market in Japan. These technologies enable organizations to analyze vast amounts of data and derive actionable insights. As companies increasingly adopt AI and ML, the demand for prescriptive analytics solutions is expected to rise. In fact, a recent report indicates that the adoption of AI in analytics is anticipated to reach 40% by 2026. This integration not only enhances predictive capabilities but also allows for more precise recommendations, thereby driving growth in the prescriptive analytics market.

Rising Demand for Data-Driven Insights

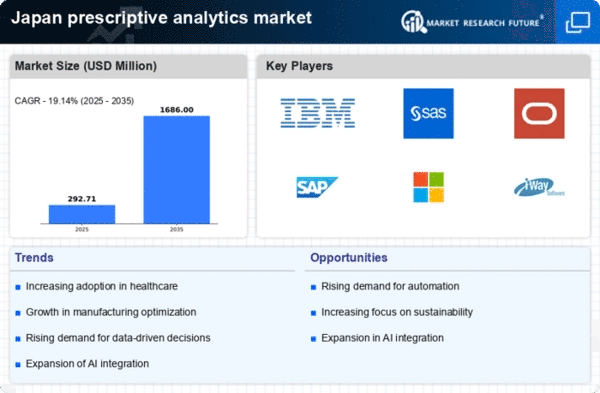

The prescriptive analytics market in Japan is experiencing a notable surge in demand for data-driven insights across various sectors. Organizations are increasingly recognizing the value of leveraging data to inform strategic decisions. This trend is particularly evident in industries such as finance and healthcare, where data analytics can lead to improved operational efficiency and enhanced customer experiences. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for businesses to remain competitive in a rapidly evolving landscape, thereby propelling the prescriptive analytics market forward.

Growing Importance of Customer Experience

Enhancing customer experience is emerging as a vital driver for the prescriptive analytics market in Japan. Organizations are recognizing that understanding customer behavior and preferences is essential for maintaining competitiveness. Prescriptive analytics tools enable businesses to analyze customer data and tailor their offerings accordingly. This trend is particularly relevant in the retail and e-commerce sectors, where personalized experiences can lead to increased customer loyalty and sales. As companies prioritize customer-centric strategies, the demand for prescriptive analytics solutions is expected to rise, further propelling the growth of the prescriptive analytics market.

Regulatory Compliance and Risk Management

In Japan, regulatory compliance and risk management are becoming critical drivers for the prescriptive analytics market. Organizations are under increasing pressure to adhere to stringent regulations, particularly in sectors such as finance and healthcare. Prescriptive analytics tools can assist in identifying potential risks and ensuring compliance with regulatory standards. This is particularly relevant given that non-compliance can result in substantial financial penalties. As a result, businesses are investing in prescriptive analytics solutions to mitigate risks and enhance their compliance strategies, thereby contributing to the overall growth of the prescriptive analytics market.