Investment in Advanced Technologies

Investment in advanced technologies such as artificial intelligence (AI) and machine learning (ML) is a key driver of the prescriptive analytics market in South America. Organizations are increasingly integrating these technologies into their analytics frameworks to enhance predictive capabilities and automate decision-making processes. In 2025, the AI market in South America is projected to reach $5 billion, indicating a robust interest in innovative solutions. This influx of investment is likely to facilitate the development of sophisticated prescriptive analytics tools, enabling businesses to derive actionable insights from complex data sets. As companies seek to harness the power of AI and ML, the prescriptive analytics market is expected to witness substantial growth, driven by the demand for smarter, more efficient analytics solutions.

Emergence of Smart Cities Initiatives

The emergence of smart cities initiatives across South America is significantly impacting the prescriptive analytics market. Governments and municipalities are increasingly investing in smart technologies to improve urban infrastructure, enhance public services, and promote sustainability. Prescriptive analytics plays a crucial role in these initiatives by providing insights for urban planning, traffic management, and resource optimization. In 2025, investments in smart city projects in the region are projected to exceed $30 billion, creating substantial opportunities for analytics providers. This trend indicates a growing recognition of the importance of data-driven decision making in urban development, which is likely to propel the prescriptive analytics market as cities strive to become more efficient and livable.

Growing Focus on Operational Efficiency

A growing focus on operational efficiency is driving the prescriptive analytics market in South America. Organizations are increasingly seeking ways to streamline processes, reduce costs, and enhance productivity. By employing prescriptive analytics, companies can identify inefficiencies and optimize resource allocation, leading to improved operational performance. In 2025, it is estimated that businesses in the region will allocate approximately $2 billion towards analytics solutions aimed at enhancing efficiency. This trend suggests that the prescriptive analytics market will continue to thrive as organizations prioritize data-driven strategies to achieve operational excellence and maintain a competitive edge.

Expansion of E-Commerce and Digital Services

The rapid expansion of e-commerce and digital services in South America is significantly influencing the prescriptive analytics market. As online shopping continues to gain traction, businesses are increasingly adopting prescriptive analytics to enhance inventory management, optimize pricing strategies, and improve customer engagement. In 2025, e-commerce sales in the region are expected to reach approximately $100 billion, creating a fertile ground for analytics solutions. Companies are utilizing prescriptive analytics to analyze consumer behavior and preferences, enabling them to tailor offerings effectively. This trend indicates a growing reliance on data-driven insights, which is likely to bolster the prescriptive analytics market as organizations strive to meet the demands of a digital-first economy.

Rising Demand for Data-Driven Decision Making

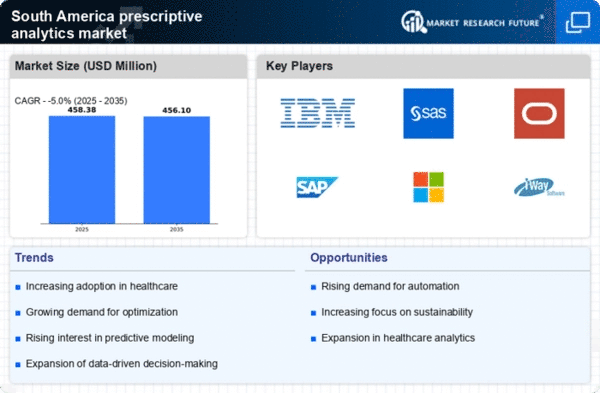

The prescriptive analytics market in South America is experiencing a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are leveraging advanced analytics to optimize operations, enhance customer experiences, and drive profitability. In 2025, the market is projected to grow at a CAGR of approximately 25%, reflecting a shift towards data-centric strategies. This trend is particularly evident in sectors such as retail and finance, where businesses are utilizing prescriptive analytics to forecast trends and allocate resources efficiently. The growing emphasis on actionable insights is likely to propel the prescriptive analytics market forward, as firms seek to remain competitive in a rapidly evolving landscape.