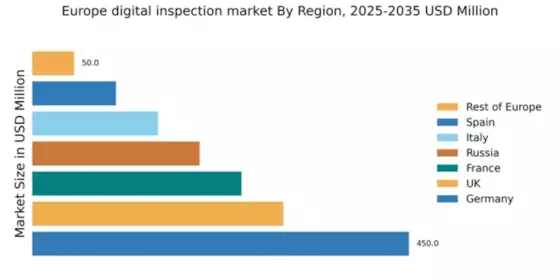

Germany : Strong Growth Driven by Innovation

Germany holds a dominant position in the European digital inspection market, accounting for 45% of the total market share with a value of $450.0 million. Key growth drivers include advancements in automation and Industry 4.0 initiatives, which are enhancing operational efficiencies. The demand for digital inspection solutions is rising, particularly in manufacturing and automotive sectors, supported by government policies promoting digital transformation and sustainability. Infrastructure investments are also bolstering industrial development, creating a conducive environment for market growth.

UK : Innovation Fuels Market Expansion

The UK digital inspection market is valued at $300.0 million, representing 30% of the European market share. Growth is driven by increasing demand for quality assurance in manufacturing and construction sectors. Regulatory frameworks, such as the Health and Safety at Work Act, are pushing companies to adopt advanced inspection technologies. The market is also benefiting from investments in smart infrastructure and digital technologies, enhancing operational capabilities across industries.

France : Diverse Applications Drive Demand

France's digital inspection market is valued at $250.0 million, capturing 25% of the European market. The growth is propelled by the aerospace and automotive industries, which are increasingly adopting digital inspection technologies for quality control. Government initiatives aimed at promoting innovation and sustainability are also significant drivers. The regulatory environment encourages the use of advanced technologies, ensuring compliance with safety standards and enhancing operational efficiency.

Russia : Industrial Demand on the Rise

Russia's digital inspection market is valued at $200.0 million, accounting for 20% of the European market share. Key growth drivers include the modernization of industrial sectors and increased investments in infrastructure. Demand for digital inspection solutions is particularly strong in oil and gas, manufacturing, and construction. However, regulatory challenges and economic fluctuations pose risks to market stability, necessitating adaptive strategies from businesses operating in the region.

Italy : Strong Focus on Quality Assurance

Italy's digital inspection market is valued at $150.0 million, representing 15% of the European market. The growth is primarily driven by the manufacturing sector, where quality assurance is critical. Government initiatives supporting digitalization and innovation are fostering a favorable environment for market expansion. The demand for digital inspection technologies is also rising in the automotive and aerospace industries, reflecting a broader trend towards automation and efficiency.

Spain : Investment in Technology and Infrastructure

Spain's digital inspection market is valued at $100.0 million, capturing 10% of the European market share. The growth is driven by investments in technology and infrastructure, particularly in the construction and energy sectors. Regulatory frameworks are encouraging the adoption of digital inspection solutions to enhance safety and compliance. The competitive landscape is evolving, with both local and international players vying for market share, creating opportunities for innovation and collaboration.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe digital inspection market is valued at $50.0 million, representing 5% of the total market. Growth is uneven across various countries, influenced by local regulations and industrial needs. Key drivers include the push for digitalization in manufacturing and construction sectors. The competitive landscape features a mix of local and international players, each adapting to regional market dynamics. Opportunities exist in niche applications, particularly in emerging industries.