Increased Data Volume

The exponential growth of data generated by organizations is a primary driver for the Enterprise Information Archiving Market. As businesses increasingly rely on digital communication and data storage, the volume of information requiring management continues to rise. According to recent estimates, the total amount of data created globally is expected to reach 175 zettabytes by 2025. This surge necessitates robust archiving solutions to ensure that organizations can efficiently store, retrieve, and manage their data. Consequently, the demand for enterprise information archiving solutions is likely to increase, as companies seek to optimize their data management strategies and ensure compliance with various regulations. The Enterprise Information Archiving Market is thus positioned to benefit from this trend, as organizations invest in technologies that can handle large volumes of data while maintaining accessibility and security.

Cloud-Based Archiving Solutions

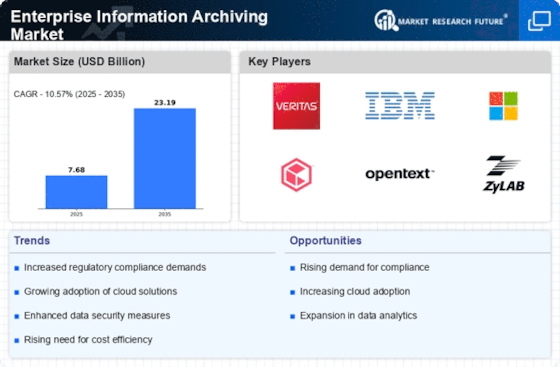

The shift towards cloud computing is significantly influencing the Enterprise Information Archiving Market. Organizations are increasingly adopting cloud-based archiving solutions due to their scalability, cost-effectiveness, and ease of access. Cloud archiving allows businesses to store vast amounts of data without the need for extensive on-premises infrastructure, which can be both costly and complex to manage. As of 2025, it is estimated that over 70% of organizations will utilize cloud services for their data management needs. This trend is likely to drive the demand for cloud-based archiving solutions, as companies seek to leverage the benefits of cloud technology while ensuring their data is securely archived. The Enterprise Information Archiving Market is thus poised for growth as more organizations transition to cloud-based solutions.

Enhanced Data Security Measures

The rising threat of cyberattacks and data breaches has heightened the focus on data security within the Enterprise Information Archiving Market. Organizations are increasingly aware of the need to protect sensitive information from unauthorized access and potential loss. As a response, many are investing in advanced archiving solutions that incorporate robust security features, such as encryption, access controls, and audit trails. According to industry reports, The Enterprise Information Archiving Market is projected to reach 345.4 billion USD by 2026, indicating a strong correlation between data security investments and the demand for enterprise information archiving solutions. This trend suggests that as organizations enhance their security measures, the Enterprise Information Archiving Market will likely see a corresponding increase in demand for secure archiving solutions that safeguard critical data.

Regulatory Compliance Requirements

Regulatory compliance remains a critical driver for the Enterprise Information Archiving Market. Organizations across various sectors are subject to stringent regulations regarding data retention, privacy, and security. For instance, regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) impose strict guidelines on how data should be archived and managed. Failure to comply with these regulations can result in severe penalties and reputational damage. As a result, businesses are increasingly adopting archiving solutions that not only facilitate compliance but also streamline their data management processes. The Enterprise Information Archiving Market is thus experiencing growth as organizations prioritize compliance-driven archiving solutions to mitigate risks and enhance their operational efficiency.

Integration with Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is emerging as a key driver for the Enterprise Information Archiving Market. These technologies enable organizations to automate data classification, retrieval, and analysis, thereby enhancing the efficiency of archiving processes. AI and ML can help organizations identify patterns in data usage, optimize storage solutions, and improve compliance with regulatory requirements. As businesses increasingly recognize the value of leveraging these technologies, the demand for enterprise information archiving solutions that incorporate AI and ML capabilities is likely to rise. This trend indicates a shift towards more intelligent archiving solutions that not only store data but also provide actionable insights, positioning the Enterprise Information Archiving Market for substantial growth.