Rising Data Volume

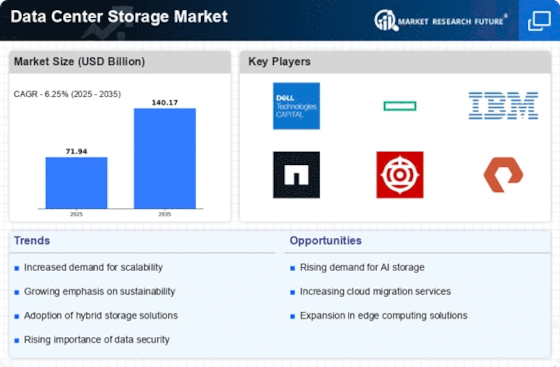

The exponential increase in data generation across various sectors appears to be a primary driver for the Data Center Storage Market. As organizations continue to adopt digital transformation strategies, the volume of data produced is projected to reach 175 zettabytes by 2025. This surge necessitates robust storage solutions to manage, store, and retrieve vast amounts of information efficiently. Consequently, data centers are compelled to invest in advanced storage technologies to accommodate this growing demand. The need for scalable storage solutions that can handle large datasets is likely to propel the market forward, as businesses seek to optimize their data management capabilities.

Focus on Energy Efficiency

The growing focus on energy efficiency is becoming a significant driver for the Data Center Storage Market. As energy costs rise and environmental concerns intensify, organizations are seeking storage solutions that minimize energy consumption. Data centers are responsible for a substantial portion of global energy usage, prompting a shift towards more sustainable practices. The market for energy-efficient storage solutions is expected to expand as companies prioritize reducing their carbon footprint. This trend not only aligns with corporate sustainability goals but also drives innovation in storage technologies, as manufacturers develop solutions that offer both performance and energy efficiency.

Demand for Enhanced Data Security

The growing emphasis on data security and compliance is a crucial driver for the Data Center Storage Market. With increasing cyber threats and stringent regulations, organizations are prioritizing secure storage solutions to protect sensitive information. The Data Center Storage is projected to reach approximately 300 billion dollars by 2025, reflecting the heightened focus on safeguarding data. As businesses seek to mitigate risks associated with data breaches, they are likely to invest in advanced storage technologies that offer robust security features. This trend not only enhances data protection but also drives the demand for innovative storage solutions within data centers.

Emergence of Hybrid Cloud Solutions

The increasing adoption of hybrid cloud solutions is influencing the Data Center Storage Market significantly. Organizations are increasingly leveraging a combination of on-premises and cloud storage to enhance flexibility and scalability. According to recent estimates, the hybrid cloud market is expected to grow at a compound annual growth rate of over 20% through 2025. This trend indicates a shift in how businesses approach data storage, as they seek to balance cost-effectiveness with performance. The integration of hybrid cloud solutions necessitates advanced storage systems that can seamlessly operate across different environments, thereby driving innovation and investment in the data center storage sector.

Technological Advancements in Storage Solutions

Technological advancements in storage solutions are reshaping the Data Center Storage Market. Innovations such as NVMe (Non-Volatile Memory Express) and SSD (Solid State Drive) technologies are enhancing storage performance and efficiency. The market for SSDs is expected to witness substantial growth, with projections indicating a market size of over 100 billion dollars by 2025. These advancements enable data centers to achieve faster data access speeds and improved reliability, which are essential for meeting the demands of modern applications. As organizations increasingly rely on high-performance storage solutions, the adoption of these technologies is likely to drive growth in the data center storage sector.