North America: Increased automotive seating systems and components

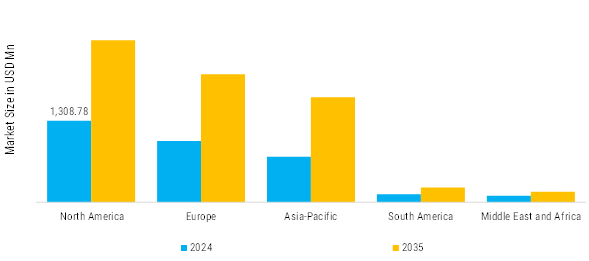

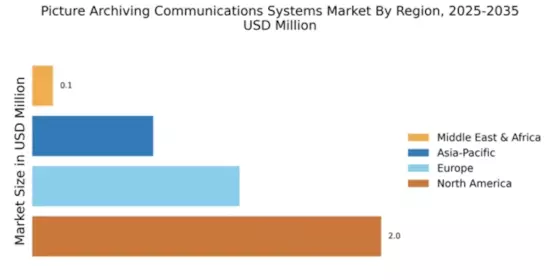

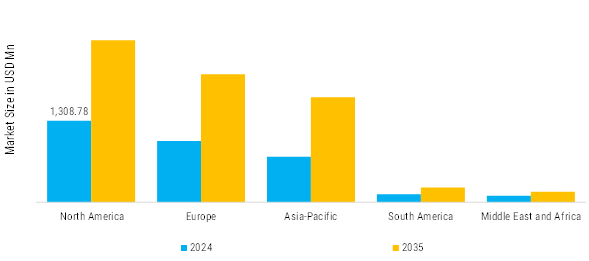

North America is characterized by consolidation in enterprise, hybrid cloud utilization, and governance that is prepared for AI, all under persistent pressures for acute care. Prior availability, turnaround time and repeat-exam reduction continue to be the operational currencies by which boards assess imaging IT performance through indicator-style dashboards across multi-hospital networks. Health systems prioritize interoperability that is anchored in standards-DICOM for imaging objects and HL7/FHIR for orders, results, and identity context-so priors can travel with confidence from emergency to inpatient settings and from inpatient to ambulatory settings, without brittle integrations that contribute to delays and providing unnecessary duplicate exposure risk during volume spikes.

Europe: Emerging automotive seating systems and components

Europe's PACS market has three main factors governing actions: public procurement policy, regional interoperability efforts, and equity-related requirements for funding and accreditation that embed internationally accepted standards and lifecycle sustainability. This means that the conformance artifacts, maintainability, and training have become as important compared to the features in vendor selection in contrast to the United States. The expectations related to cross-border mobility and regionalized care models suggest that priors will be expected to follow patients even across hospitals and countries. This is where DICOM fidelity with HL7/FHIR integration with RIS/EHR, must be the baseline utility of PACS systems to assure safe identity matching, integrity between orders and results, and longitudinal access during referrals, perioperative instances, and tumor boards.

Asia-Pacific: Rapidly Growing automotive seating systems and components

Asia Pacific can be characterized by scale, heterogeneity, and modernization in phases, as governments and health networks consider the demands of rapid urban growth against rural access as part of their universal health coverage (UHC) obligations, explicitly requiring internationally accepted standards, lifecycle maintenance, and education of the workforce in imaging health informatics programs. Accreditation and procurement increasingly require DICOM fidelity and HL7/FHIR integration in order for orders, results, and demographics to remain reconciled across mixed public–private environments to prevent identity drift, and prior records lost to follow the patient’s transitions from primary care, urban center, and specialty hospital care.

Middle East and Africa: Emerging automotive seating

MEA’s PACS trajectory reflects simultaneous top‑down national digital health programs and bottom‑up capacity building across diverse provider ecosystems, making governed interoperability and resilience the decisive criteria for funding and scale in mixed public private markets. Procurement increasingly specifies internationally accepted standards, with DICOM fidelity and HL7/FHIR integration required so priors, orders, and results remain consistent as patients move between public hospitals, defense/teaching institutions, and contracted private providers, reducing identity drift and missed priors that drive repeat exposure and delays. Ministries and health authorities evaluate performance through comparable operational proxy’s time‑to‑first‑view in acute pathways, prior‑hit rates across facilities, and repeat‑exam trends so PACS platforms that surface these analytics by site and modality enable targeted remediation and verifiable improvements aligned with governance dashboards.

South America: Rapidly Develop automotive seating

South America is primarily motivated by table-pushing demands from health systems to create more equitable health system goals, capabilities targeting standard-based enterprise imaging, decreasing duplication, shortening turnaround, and providing access across geographic dispersion with comparable operational indicators and governance demands. Public purchasers and larger private groups are increasing requiring documented DICOM integrity and HL7/FHIR interfacing so that priors/prior results are shared between public hospitals, contracted providers.