Market Analysis

In-depth Analysis of Electronic Films Market Industry Landscape

The electronic film industry has witnessed dynamic changes due to technological advancements as well as changing consumer preferences. As electronic devices are increasingly being adopted in everyday life, demand for high-performance electronic films has continued to rise. Manufacturers are compelled to create films that are usually thin and flexible in order improve performance and durability of many electrical appliances.

The rapid evolution of display technology is one of the main factors driving market dynamics. The growth of electronic films requirement goes hand-in-hand with the spread of displays – in tablets, TVs/Screens, smartphones other electronics. As consumers want sharper images, brighter colors or more adaptable screens; manufacturers are under pressure from these evolving expectations that they employ novel materials in electronics. This has led to a cycle of innovations within this sector with players spending heavily on R&D just so that they can remain competitive amidst stiff rivalry.

Additionally, shrinking trends within electronic gadgets impact the market dynamics for electronic films. With reduced sizes of electronic parts there comes a growing need for thin and light coatings that can protect and enhance them. This trend is evident in the development of wearable devices, where electronic films improve both their aesthetic appeal and functionality.

Environmental aspects are influencing the market dynamics of electronic films. Moreover, as sustainability becomes more appreciated, there is a growing demand for eco-friendly electronic films that minimize the environmental impact of electronic products. As such, manufacturers have been exploring possible solutions to this problem by creating materials that are high-performance while still being sustainable. This ongoing transition mirrors a larger shift in sustainable and responsible production within the electronics industry.

The world economy also affects market dynamics in relation to electronic films. Political conflicts, currency fluctuations and trade barriers may have impacts on commodity prices including raw material acquisition and manufacturing cost.These external drivers affect the overall price of electric films which influences both producers and consumers who buy them.Therefore, businesses operating in this sector of economy are confronted with a complex set of economic factors if they want to be competitive and profitable.

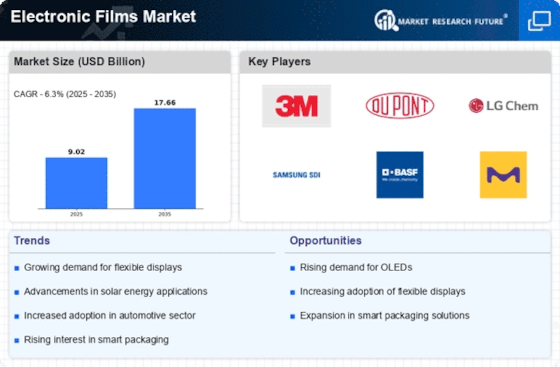

Electronic film industry is a hotly contested market with both established and new players involved. On the other hand, seasoned companies emphasize on strong partnerships with electronics manufacturers so as to secure long-term contracts and remain the leaders in the market. New entrants and smaller firms, however, focus on innovation and agility to gain an edge over rivals by leveraging breakthrough technologies or reduced cost solutions for their target markets.

Leave a Comment