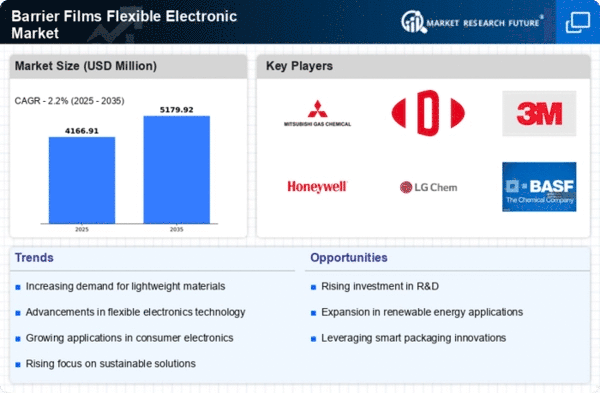

Market Growth Projections

The Global Barrier Films Flexible Electronic Market Industry is poised for substantial growth, with projections indicating a market value of 4.08 USD Billion in 2024 and an anticipated increase to 29.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 19.85% from 2025 to 2035, reflecting the increasing demand for flexible electronics across various sectors. The market's expansion is driven by technological advancements, evolving consumer preferences, and the rising adoption of wearable devices, positioning the industry for a dynamic future.

Growing Adoption of Wearable Devices

The increasing popularity of wearable devices significantly influences the Global Barrier Films Flexible Electronic Market Industry. As consumers become more health-conscious and technology-savvy, the demand for wearables such as fitness trackers and smartwatches continues to rise. These devices require flexible electronics that can withstand daily use while maintaining performance. Consequently, the need for effective barrier films that protect sensitive electronic components from environmental factors is paramount. This trend is likely to drive market growth, contributing to a projected compound annual growth rate of 19.85% from 2025 to 2035, as manufacturers strive to meet consumer expectations.

Sustainability Trends in Electronics

Sustainability has emerged as a pivotal factor in the Global Barrier Films Flexible Electronic Market Industry. As environmental concerns grow, manufacturers are increasingly focusing on eco-friendly materials and processes. The shift towards sustainable practices not only meets regulatory requirements but also aligns with consumer preferences for environmentally responsible products. Barrier films made from biodegradable or recyclable materials are gaining traction, potentially reshaping the market landscape. This trend may lead to increased investments in research and development, further driving innovation and growth within the industry, as companies seek to balance performance with sustainability.

Rising Demand for Flexible Electronics

The Global Barrier Films Flexible Electronic Market Industry experiences a notable surge in demand for flexible electronics, driven by advancements in technology and consumer preferences. Flexible electronics are increasingly utilized in various applications, including wearables, smartphones, and smart packaging. This trend is projected to contribute significantly to the market's growth, with the industry expected to reach 4.08 USD Billion in 2024. As manufacturers seek to innovate and enhance product offerings, the demand for barrier films that provide protection against moisture and oxygen is likely to rise, thereby propelling the market forward.

Regulatory Support for Advanced Materials

Regulatory frameworks supporting the development and use of advanced materials significantly impact the Global Barrier Films Flexible Electronic Market Industry. Governments worldwide are promoting research and innovation in materials science, which fosters the growth of barrier films for flexible electronics. Initiatives aimed at enhancing the safety and performance of electronic products encourage manufacturers to adopt advanced barrier film technologies. This regulatory support is likely to stimulate market growth, as companies are incentivized to invest in new materials that enhance product durability and functionality, thereby expanding the overall market.

Technological Advancements in Barrier Films

Technological innovations play a crucial role in the Global Barrier Films Flexible Electronic Market Industry. The development of new materials and manufacturing processes enhances the performance of barrier films, making them more effective in protecting electronic components. For instance, the introduction of nanotechnology in barrier film production has led to improved barrier properties and flexibility. These advancements not only meet the growing requirements of flexible electronics but also support the industry's expansion, with projections indicating a market value of 29.9 USD Billion by 2035. As technology continues to evolve, the demand for high-performance barrier films is expected to increase.