Competitive Labor Market Dynamics

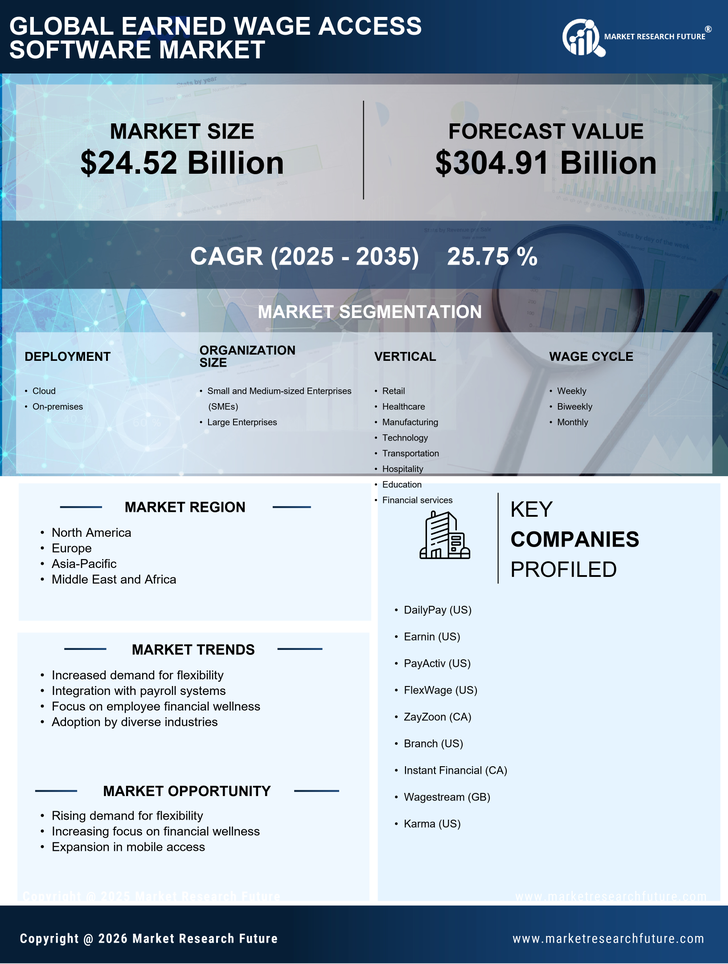

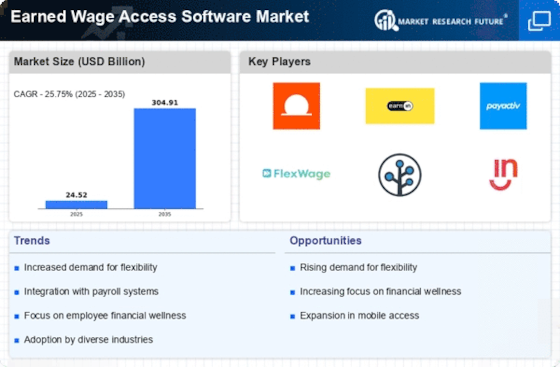

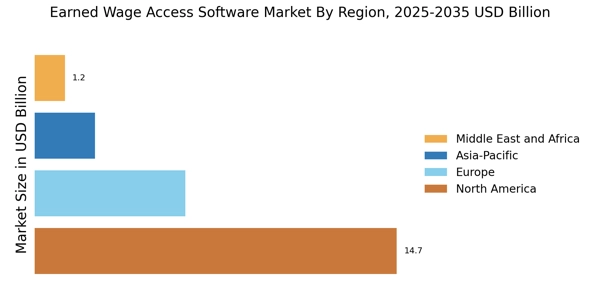

The Earned Wage Access Software Market is significantly influenced by the dynamics of a competitive labor market. As organizations strive to attract and retain top talent, offering earned wage access has emerged as a compelling differentiator. Companies that provide this benefit are likely to stand out in a crowded job market, particularly as employees seek more than just traditional compensation packages. Recent data suggests that businesses implementing earned wage access solutions experience a 25% increase in job applications. This competitive advantage is prompting more employers to explore earned wage access software as a strategic tool for talent acquisition and retention. Consequently, the market is projected to expand rapidly, with an anticipated growth rate of 13% annually, as more organizations recognize the value of this innovative employee benefit.

Regulatory Support and Compliance

The Earned Wage Access Software Market is benefiting from an evolving regulatory landscape that increasingly supports earned wage access solutions. Governments are recognizing the importance of financial wellness for employees, leading to the establishment of guidelines that promote fair access to earned wages. This regulatory support not only legitimizes the industry but also encourages employers to adopt such solutions. For instance, recent legislative changes in various regions have made it easier for companies to implement earned wage access without facing legal hurdles. As a result, the market is expected to expand, with a projected growth rate of 12% annually. This favorable regulatory environment is likely to foster innovation and competition among software providers, ultimately enhancing the quality and accessibility of earned wage access solutions.

Technological Integration and Innovation

The Earned Wage Access Software Market is witnessing significant advancements in technology that enhance the functionality and user experience of earned wage access solutions. Innovations such as mobile applications and real-time data analytics are making it easier for employees to access their earned wages seamlessly. The integration of artificial intelligence and machine learning is also streamlining the process, allowing for quicker approvals and transactions. As technology continues to evolve, the market is expected to grow at a CAGR of 16%, driven by these innovations. Employers are increasingly adopting sophisticated earned wage access software to meet the demands of a tech-savvy workforce. This technological integration not only improves operational efficiency but also positions companies as forward-thinking employers, further driving the adoption of earned wage access solutions.

Rising Demand for Flexible Payment Solutions

The Earned Wage Access Software Market is experiencing a notable surge in demand for flexible payment solutions. As employees increasingly seek financial autonomy, the ability to access earned wages before the traditional payday is becoming a critical factor in job satisfaction. Recent studies indicate that companies offering such solutions witness a 20% increase in employee retention rates. This trend is particularly pronounced among younger workers, who prioritize financial flexibility. Employers are recognizing that integrating earned wage access can enhance their competitive edge in attracting talent. Furthermore, the market is projected to grow at a compound annual growth rate (CAGR) of 15% over the next five years, driven by this rising demand. Consequently, businesses are investing in earned wage access software to meet employee expectations and improve overall workplace morale.

Increased Focus on Employee Financial Wellness

The Earned Wage Access Software Market is increasingly aligned with the growing emphasis on employee financial wellness. Organizations are recognizing that financial stress can adversely affect productivity and overall employee well-being. By offering earned wage access, employers can provide a valuable resource that alleviates financial burdens, thereby enhancing employee satisfaction and engagement. Recent surveys indicate that 70% of employees would prefer to work for companies that offer financial wellness programs, including earned wage access. This shift in focus is prompting businesses to invest in software solutions that facilitate early wage access, contributing to a projected market growth of 14% over the next few years. As companies prioritize employee well-being, the demand for earned wage access software is likely to continue its upward trajectory.