Access Control Market Summary

As per MRFR analysis, the Access Control Market was estimated at 13384.94 USD Million in 2024. The Access Control industry is projected to grow from 14571.12 USD Million in 2025 to 34060.96 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 8.86 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Access Control Market is experiencing robust growth driven by technological advancements and evolving security needs.

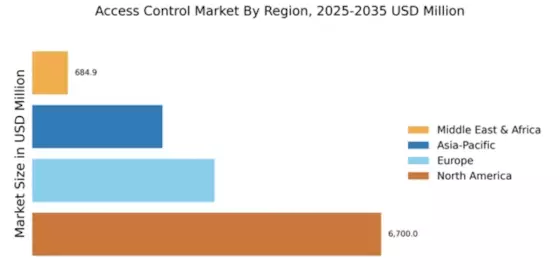

- The integration of biometric technologies is becoming increasingly prevalent, particularly in North America, which remains the largest market.

- Cloud-based access control solutions are gaining traction, especially in the Asia-Pacific region, recognized as the fastest-growing market.

- There is a notable emphasis on user experience and customization, particularly within the residential segment, which is currently the largest.

- Rising security concerns and increased adoption of mobile access solutions are key drivers propelling growth in the commercial segment, which is the fastest-growing.

Market Size & Forecast

| 2024 Market Size | 13384.94 (USD Million) |

| 2035 Market Size | 34060.96 (USD Million) |

| CAGR (2025 - 2035) | 8.86% |

Major Players

ASSA ABLOY (SE), Johnson Controls (US), Honeywell (US), Allegion (IE), Dormakaba (CH), Genetec (CA), Morse Watchmans (US), AMAG Technology (US), Axis Communications (SE), representing leading access control companies, access control manufacturers, access control vendors, and prominent access control system brands operating globally.