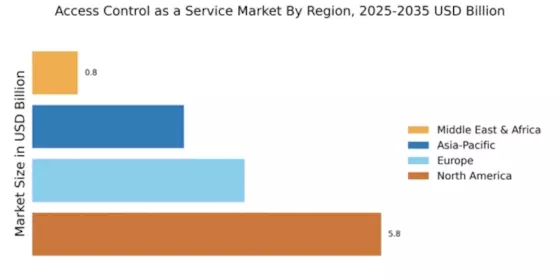

North America : Market Leader in Access Control

North America is poised to maintain its leadership in the Access Control as a Service (ACaaS) market, holding a significant market share of 5.75 in 2024. The region's growth is driven by increasing security concerns, technological advancements, and a shift towards cloud-based solutions. Regulatory frameworks supporting cybersecurity and data protection further catalyze demand, making it a fertile ground for innovation and investment.

The competitive landscape is robust, with key players like Johnson Controls, Honeywell, and ASSA ABLOY leading the charge. The U.S. stands out as a major contributor, supported by a strong infrastructure and a high adoption rate of advanced security technologies. The presence of established companies and startups alike fosters a dynamic environment, ensuring continuous evolution in service offerings and customer engagement.

Europe : Emerging Market with Growth Potential

Europe is witnessing a burgeoning Access Control as a Service (ACaaS) market, with a market size of 3.5 in 2024. The region's growth is fueled by increasing regulatory requirements for security and privacy, alongside a rising demand for integrated security solutions. Countries are investing in smart technologies and infrastructure, which is expected to drive further adoption of access control systems across various sectors.

Leading countries such as Germany, the UK, and France are at the forefront of this growth, with a competitive landscape featuring key players like Allegion and Genetec. The European market is characterized by a mix of established firms and innovative startups, creating a vibrant ecosystem. As organizations prioritize security, the demand for scalable and flexible access control solutions is set to rise significantly.

Asia-Pacific : Rapid Growth in Security Solutions

The Asia-Pacific region is emerging as a significant player in the Access Control as a Service (ACaaS) market, with a market size of 2.5 in 2024. The growth is driven by rapid urbanization, increasing security threats, and a rising awareness of the importance of access control systems. Governments are also implementing stricter regulations to enhance security, which is further propelling market demand across various sectors, including commercial and residential.

Countries like China, Japan, and India are leading the charge, with a competitive landscape that includes both local and international players. The presence of companies such as Brivo and AMAG Technology highlights the region's potential for innovation and growth. As the market matures, the focus will shift towards integrating advanced technologies like AI and IoT into access control solutions, enhancing their effectiveness and user experience.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa (MEA) region is gradually emerging in the Access Control as a Service (ACaaS) market, with a market size of 0.75 in 2024. The growth is primarily driven by increasing investments in infrastructure and a heightened focus on security due to rising crime rates. Governments are also recognizing the need for advanced security solutions, leading to a favorable regulatory environment that encourages the adoption of access control systems.

Countries like the UAE and South Africa are at the forefront of this growth, with a competitive landscape that includes both local and international players. The presence of key companies is beginning to shape the market, as they introduce innovative solutions tailored to regional needs. As awareness of security solutions increases, the MEA market is expected to witness significant growth in the coming years.