Advancements in Drone Technology

Technological advancements in drone capabilities are significantly influencing the US Drones Energy Industry Market. Innovations such as improved battery life, enhanced payload capacities, and sophisticated sensors are enabling drones to perform complex tasks in energy sectors more effectively. For instance, drones equipped with thermal imaging cameras can detect energy losses in solar panels, thereby optimizing energy production. The market for drone technology is expected to reach USD 10 billion by 2027, with a substantial portion attributed to energy applications. These advancements not only improve operational efficiency but also reduce costs associated with traditional energy monitoring methods, making drones an attractive option for energy companies.

Regulatory Support for Drone Operations

The regulatory landscape surrounding drone operations in the US is evolving, providing a favorable environment for the Drones Energy Industry Market. The Federal Aviation Administration (FAA) has implemented regulations that facilitate the integration of drones into commercial airspace, particularly for energy applications. As of January 2026, the FAA's Remote ID rule is in effect, which enhances safety and accountability for drone operations. This regulatory support is crucial for energy companies looking to leverage drones for inspections, surveying, and maintenance tasks. The anticipated growth in regulatory frameworks is likely to bolster the market, as companies can operate drones with greater confidence and compliance.

Growing Demand for Renewable Energy Sources

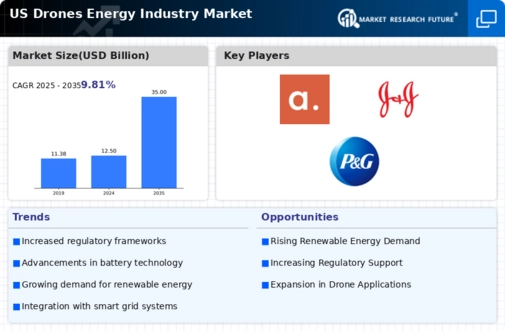

The US Drones Energy Industry Market is experiencing a notable surge in demand for renewable energy sources, driven by a national commitment to reduce carbon emissions and transition to sustainable energy. As of January 2026, the US aims to achieve a 50% reduction in greenhouse gas emissions by 2030, which has led to increased investments in solar, wind, and other renewable energy projects. Drones are being utilized for site assessments, monitoring, and maintenance of these energy installations, enhancing operational efficiency. The integration of drones in renewable energy sectors is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years, indicating a robust market potential for drone applications in energy generation and management.

Focus on Environmental Monitoring and Compliance

The US Drones Energy Industry Market is also driven by a heightened focus on environmental monitoring and compliance. Energy companies are under increasing pressure to adhere to environmental regulations and minimize their ecological footprint. Drones offer a cost-effective solution for monitoring emissions, assessing environmental impacts, and ensuring compliance with regulatory standards. As of January 2026, the market for environmental monitoring drones is projected to grow at a CAGR of 12%, reflecting the increasing reliance on drone technology for environmental assessments. This trend not only supports regulatory compliance but also enhances the sustainability efforts of energy companies, positioning drones as essential tools in the energy sector.

Increased Investment in Infrastructure Development

Investment in infrastructure development is a key driver for the US Drones Energy Industry Market. The Biden administration's infrastructure plan allocates significant funding for renewable energy projects, which in turn creates opportunities for drone applications in energy infrastructure. Drones are increasingly being employed for surveying land, inspecting power lines, and monitoring wind farms, thereby streamlining project execution. The US energy sector is projected to invest over USD 100 billion in infrastructure improvements by 2030, and drones are expected to play a pivotal role in these initiatives. This influx of investment is likely to enhance the demand for drone services in the energy sector.