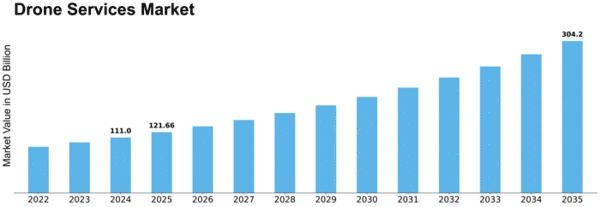

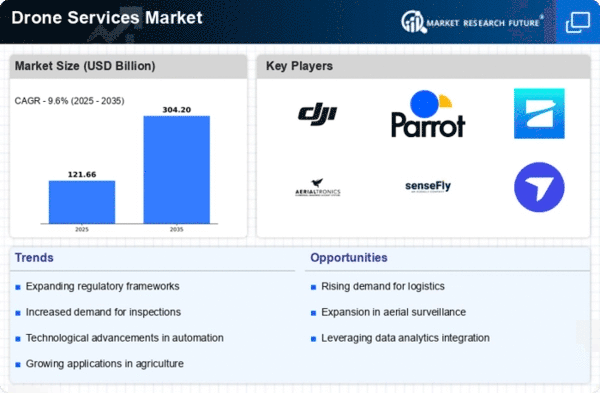

Drone Services Size

Drone Services Market Growth Projections and Opportunities

The Drone Service market is following the path of substantial growth spurred by a combination of factors present in different industries that take advantage from both versatility and capabilities offered by unmanned planes. One of the main factors fueling this market is growing knowledge that drones act as great tools for collecting data, surveillance, and inspection in various industries. Demands for drone services have soared in crop acreages and construction sites to name some, driven by the fact that these devices are cost-effective as well as time efficient and safe. Technology is also playing an important role in the Drone Service market. High-resolution cameras, LiDAR sensors and thermal imaging technology allows drones to capture detailed information that carries value as insights were once difficult or impossible to obtain. In addition, artificial intelligence and machine learning gain stronger integration to enhance drone capabilities such as autonomous flying, data analysis at an advanced level along with the capability of making real-time decisions. Critical factors that affect the dynamics of Drone Service market include Regulatory developments and policy frameworks. It is essential for the drone service industry to grow as per airspace regulations, privacy laws and other legal considerations. Clear regulations and support may turn drone use into a responsible activity that is widely utilised by businesses for various purposes due to the adoption of drone services. The Drone Service market is significantly affected by the presence of key players in market competition. Both established drones service providers and startups emerging today are also involved in the development of these services. The competitive context in which drone services operate creates ample choice for customers, thereby creating a dynamic environment that encourages further technological advancements and applications of technology. Technological advancements, regulatory compliance, competitive dynamics in the marketplace and economic conditions on a global scale are factors that shape the drone service industry. This highlights the fact that even though many of these factors are in a constant evolution, especially as more and new technologies continue to emerge.

Leave a Comment