North America : Innovation and Leadership Hub

North America is poised to maintain its leadership in the agricultural drone services market, holding a significant share of 1.6 in 2024. The region's growth is driven by advanced technology adoption, increasing demand for precision agriculture, and supportive regulatory frameworks. Government initiatives promoting drone usage in agriculture further catalyze market expansion, enhancing operational efficiency and crop management.

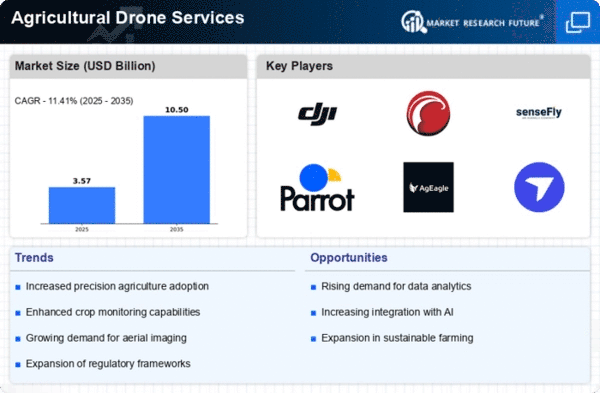

The United States stands out as a key player, with major companies like DJI, PrecisionHawk, and AgEagle Aerial Systems leading the charge. The competitive landscape is characterized by innovation and collaboration among industry leaders, ensuring a robust market presence. As agricultural practices evolve, the integration of drone technology is expected to revolutionize farming, making it more efficient and sustainable.

Europe : Emerging Market with Potential

Europe is witnessing a burgeoning interest in agricultural drone services, with a market size of 0.9. The region's growth is fueled by increasing awareness of sustainable farming practices and the need for efficient crop monitoring. Regulatory support from the European Union, including the European Union Aviation Safety Agency (EASA), is pivotal in shaping the market landscape, ensuring safety and compliance in drone operations.

Leading countries such as Germany, France, and the UK are at the forefront of this transformation, with numerous startups and established firms like Parrot and senseFly driving innovation. The competitive environment is marked by a mix of local and international players, fostering a dynamic ecosystem. As the demand for precision agriculture rises, Europe is set to become a significant player in The Agricultural Drone Services.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is rapidly emerging as a significant player in the agricultural drone services market, with a size of 0.7. The region's growth is driven by increasing agricultural productivity demands and the adoption of advanced technologies. Countries like China and India are investing heavily in drone technology to enhance crop monitoring and management, supported by favorable government policies and initiatives promoting smart farming practices.

China, with companies like XAG, is leading the charge, while India is witnessing a surge in startups focusing on drone applications in agriculture. The competitive landscape is evolving, with both established firms and new entrants vying for market share. As the region embraces technological advancements, the agricultural drone market is expected to flourish, addressing the challenges of food security and sustainable farming.

Middle East and Africa : Untapped Potential and Challenges

The Middle East and Africa region currently shows minimal activity in the agricultural drone services market, with a size of 0.0. However, there is significant untapped potential due to the increasing need for efficient agricultural practices in arid and semi-arid regions. The growth is hindered by regulatory challenges and limited infrastructure, but awareness of drone technology's benefits is gradually increasing among farmers and agricultural stakeholders.

Countries like South Africa and Kenya are beginning to explore drone applications in agriculture, albeit at a nascent stage. The competitive landscape is sparse, with few key players present. As governments start to recognize the importance of technology in agriculture, the market is expected to evolve, paving the way for future growth and investment in drone services.