Market Analysis

In-depth Analysis of Drone Services Market Industry Landscape

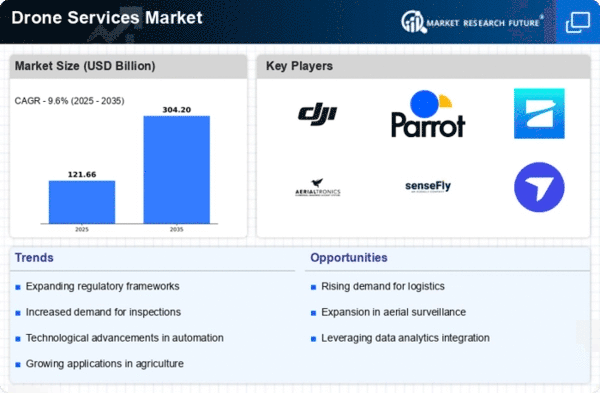

The global drone services market is set to reach US$ 65.18 BN by 2030, at a 34.6 % CAGR between years 2022-2030. Market dynamics represent an extremely rapidly growing environment, where the market is responding to the versatility and ability of unmanned aerial vehicles (UAVs). Airborne vehicles or drones, that were initially seen as leisure was now in use across a variety of sectors like agriculture, construction among others. One of the main engines building up the Drone Service market is efficiency and cost-effectiveness that drones allow to perform for numerous tasks. For instance, drones that are fitted with sensors and cameras in agriculture give farmers very useful information about the condition of their crops hence enabling precision farming and proper use of farm resources. Construction and infrastructure industries use drones for site surveys, inspections, and monitoring, offering a safer way than traditional methods. The market is additionally stimulated by widespread use of drones for aerial photography, cinematography and surveillance. Drone services meet the industry demand for unique and compelling aerial shots within media and entertainment businesses, serving filmmakers as well as content creators cost-effectively while getting the chance to create eye grabbing visuals. Regarding public safety, drones with cameras and thermal imaging capabilities are used to carry out search and rescue missions, disaster response and in monitoring large crowds or events. Drone technology is useful in situations that can be hard or dangerous for humans to access. E-commerce and the increased demand for reliable logistics solutions play a significant role in influencing developments with Drone Service market. These companies are looking at delivery services via drones to make their supply chains faster and more convenient. Drones provide an opportunity to solve logistical problems in remote or crowded areas as a future method for last-mile delivery. Those are key regulatory considerations, airspace management and public acceptability which affect the widespread adoption of drone delivery services. Artificial intelligence (AI) and machine learning algorithms help improve drone autonomy, allowing them to carry out intricate tasks without constant human involvement.

Leave a Comment