Enhanced Performance Requirements

The performance demands of modern applications, particularly those utilizing AI and machine learning, are evolving rapidly. The Direct Attached AI Storage System Market is responding to these heightened expectations by offering solutions that deliver superior speed and efficiency. As organizations implement more complex algorithms and data processing tasks, the need for high-performance storage systems becomes paramount. Direct attached storage solutions are designed to minimize latency and maximize throughput, making them ideal for applications that require real-time data access. This performance enhancement is crucial for sectors such as finance, healthcare, and autonomous vehicles, where timely data processing can significantly impact outcomes. Consequently, the market for direct attached storage systems is likely to expand as businesses prioritize performance in their storage solutions.

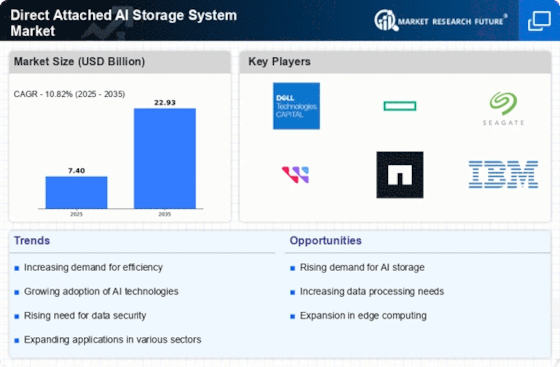

Rising Adoption of AI Technologies

The increasing integration of artificial intelligence across various sectors appears to drive the Direct Attached AI Storage System Market. As organizations seek to harness the power of AI for data analysis, machine learning, and predictive analytics, the demand for efficient storage solutions intensifies. In 2025, the AI market is projected to reach a valuation of approximately 500 billion USD, indicating a robust growth trajectory. This surge necessitates storage systems that can handle vast amounts of data generated by AI applications, thereby propelling the adoption of direct attached storage solutions. Furthermore, the need for low-latency access to data enhances the appeal of these systems, as they provide faster data retrieval compared to traditional storage methods.

Growing Data Generation and Management Needs

The exponential growth of data generated by businesses and consumers alike is a critical driver for the Direct Attached AI Storage System Market. With estimates suggesting that the world generates over 2.5 quintillion bytes of data daily, organizations are increasingly challenged to manage and store this information effectively. Direct attached storage systems offer a practical solution, providing high-capacity storage that is easily accessible. As companies strive to leverage big data for strategic decision-making, the demand for reliable and efficient storage solutions is likely to escalate. This trend is further supported by the increasing reliance on data-driven insights, which necessitate robust storage infrastructures capable of supporting advanced analytics and AI applications.

Cost-Effectiveness of Direct Attached Solutions

Cost considerations play a pivotal role in the decision-making process for organizations seeking storage solutions. The Direct Attached AI Storage System Market benefits from the cost-effectiveness of direct attached storage options compared to networked alternatives. Organizations are increasingly recognizing that direct attached systems can provide substantial savings in both initial investment and ongoing operational costs. With the ability to connect directly to servers or workstations, these systems eliminate the need for complex networking infrastructure, thereby reducing setup and maintenance expenses. As businesses continue to seek ways to optimize their IT budgets, the appeal of direct attached storage solutions is likely to grow, further driving market expansion. This trend is particularly relevant for small to medium-sized enterprises that require efficient yet affordable storage options.

Technological Advancements in Storage Solutions

Technological innovation is a key driver in the evolution of the Direct Attached AI Storage System Market. Advances in storage technologies, such as SSDs and NVMe, are enhancing the capabilities of direct attached storage systems. These innovations enable faster data transfer rates, increased reliability, and improved energy efficiency, making them more attractive to organizations. As technology continues to evolve, the integration of AI and machine learning into storage management systems is also becoming more prevalent. This integration allows for smarter data handling and optimization, further enhancing the performance of direct attached storage solutions. As organizations seek to stay competitive in a rapidly changing landscape, the adoption of cutting-edge storage technologies is likely to accelerate, thereby propelling the growth of the direct attached AI storage market.