Rising Data Storage Needs

The network attached-storage market is experiencing a surge in demand driven by the exponential growth of data generation across various sectors. As organizations increasingly rely on digital solutions, the need for efficient data storage solutions becomes paramount. In the US, it is estimated that data creation will reach 175 zettabytes by 2025, necessitating robust storage systems. This trend is particularly evident in industries such as healthcare, finance, and media, where large volumes of sensitive data require secure and accessible storage. Consequently, businesses are investing in network attached-storage solutions to manage their data effectively, thereby propelling the market forward.

Advancements in Technology

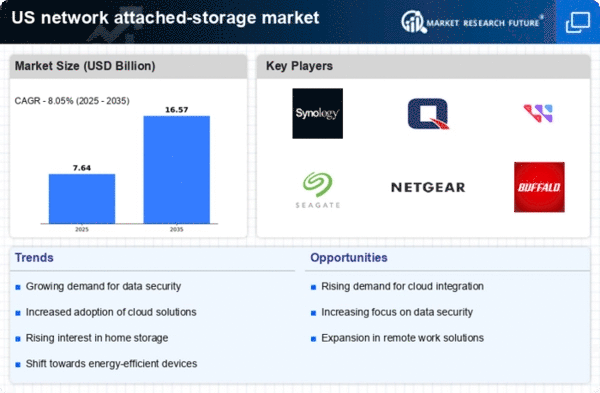

Technological advancements are playing a crucial role in shaping the network attached-storage market. Innovations such as faster processors, improved connectivity options, and enhanced data management software are making network attached-storage systems more efficient and user-friendly. The integration of artificial intelligence and machine learning into storage solutions is also emerging, allowing for smarter data organization and retrieval. In the US, the market is projected to grow at a CAGR of approximately 10% over the next few years, driven by these technological enhancements. As organizations seek to leverage cutting-edge technology, the demand for advanced network attached-storage solutions is expected to rise.

Increased Focus on Remote Work Solutions

The network attached-storage market is benefiting from the ongoing emphasis on remote work solutions. As organizations adapt to flexible work environments, the need for reliable and accessible data storage has intensified. Network attached-storage systems provide a centralized platform for employees to access and share files securely from various locations. In the US, a significant % of companies have adopted hybrid work models, which has led to a heightened demand for storage solutions that support remote collaboration. This shift is likely to continue, further driving the growth of the network attached-storage market as businesses seek to enhance productivity and data accessibility.

Regulatory Compliance and Data Governance

The network attached-storage market is significantly impacted by the increasing emphasis on regulatory compliance and data governance. Organizations in the US are facing stringent regulations regarding data protection, privacy, and retention, necessitating the implementation of effective storage solutions. Network attached-storage systems facilitate compliance by providing secure data storage and management capabilities. As businesses strive to adhere to regulations such as GDPR and HIPAA, the demand for compliant storage solutions is expected to rise. This trend indicates a growing recognition of the importance of data governance, which is likely to further propel the network attached-storage market.

Growing Need for Data Backup and Recovery Solutions

The network attached-storage market is increasingly influenced by the growing need for effective data backup and recovery solutions. With the rising threat of data loss due to cyberattacks, hardware failures, and natural disasters, organizations are prioritizing data protection strategies. Network attached-storage systems offer reliable backup options, enabling businesses to safeguard their critical information. In the US, it is estimated that data loss incidents can cost companies an average of $3 million annually, underscoring the importance of investing in robust storage solutions. This heightened awareness of data security is likely to drive demand for network attached-storage systems in the coming years.