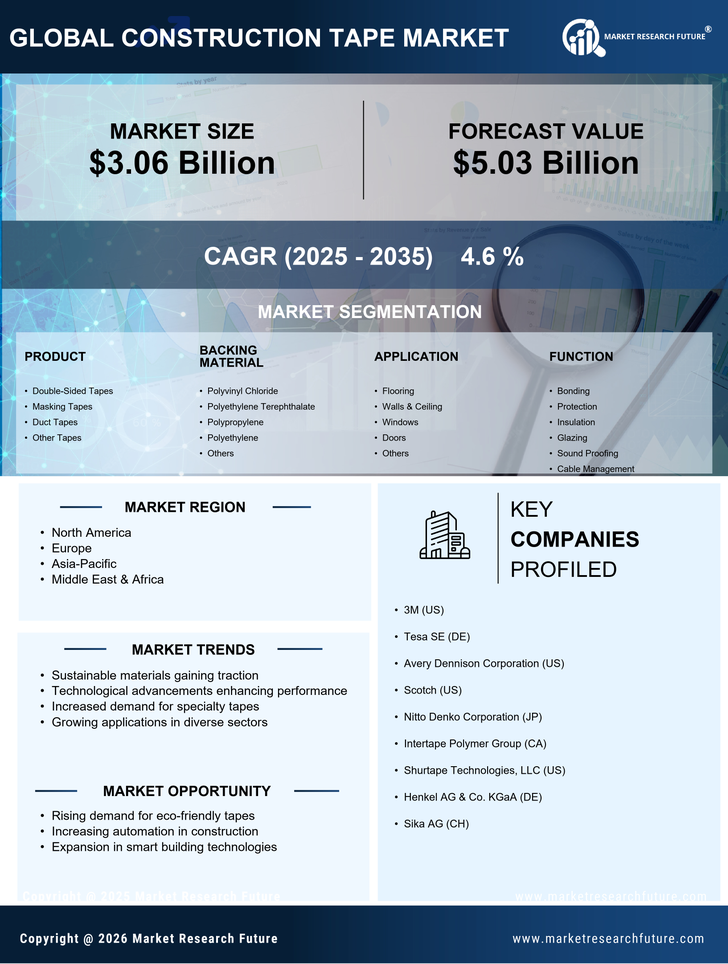

Rising Construction Activities

The Construction Tape Market is experiencing a surge in demand due to increasing construction activities across various sectors. Urbanization and infrastructure development projects are driving this growth, as more residential, commercial, and industrial buildings are being erected. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This expansion necessitates the use of construction tape for various applications, including sealing, insulation, and surface protection. As construction projects become more complex, the need for reliable and efficient materials, such as construction tape, becomes paramount. Consequently, this trend is likely to bolster the market, as construction companies seek high-quality tape solutions to meet their operational needs.

Expansion of E-Commerce Platforms

The Construction Tape Market is experiencing a transformation due to the expansion of e-commerce platforms that facilitate the distribution of construction materials. Online retailing provides construction companies and contractors with convenient access to a wide range of construction tapes, often at competitive prices. This shift towards digital purchasing is particularly appealing to smaller businesses that may lack the resources for traditional procurement methods. As e-commerce continues to grow, it is expected that the construction tape market will see an increase in sales volume, potentially rising by 5% over the next few years. The ease of online ordering and the ability to compare products are likely to enhance customer satisfaction and drive market growth.

Increased Focus on Safety Standards

The Construction Tape Market is significantly influenced by the heightened emphasis on safety standards within the construction sector. Regulatory bodies are increasingly mandating the use of safety measures to protect workers and ensure compliance with industry regulations. Construction tape plays a crucial role in this context, as it is often utilized for marking hazardous areas, securing materials, and providing visual warnings. The demand for safety-compliant products is expected to rise, with the construction tape market projected to witness a growth rate of around 4% annually. This focus on safety not only enhances worker protection but also promotes the adoption of innovative tape solutions that meet stringent safety requirements, thereby driving the market forward.

Growing Demand for Eco-Friendly Products

The Construction Tape Market is witnessing a shift towards eco-friendly products, driven by increasing environmental awareness among consumers and businesses. As sustainability becomes a key consideration in construction practices, the demand for construction tapes made from recyclable and biodegradable materials is on the rise. This trend is supported by various initiatives aimed at reducing the carbon footprint of construction activities. Market data suggests that the eco-friendly segment of the construction tape market could grow by 7% annually, as more companies seek to align their operations with sustainable practices. This growing preference for environmentally responsible products is likely to reshape the competitive landscape of the market, encouraging manufacturers to innovate and offer greener alternatives.

Technological Innovations in Tape Manufacturing

The Construction Tape Market is benefiting from technological innovations that enhance the performance and functionality of construction tapes. Advances in adhesive technologies, materials science, and manufacturing processes are leading to the development of tapes that offer superior adhesion, durability, and weather resistance. For instance, the introduction of eco-friendly adhesives and advanced backing materials is gaining traction among manufacturers. This trend is likely to attract a broader customer base, as construction companies increasingly prioritize quality and sustainability. The market is expected to grow by approximately 6% in the coming years, driven by these technological advancements that cater to the evolving needs of the construction industry.