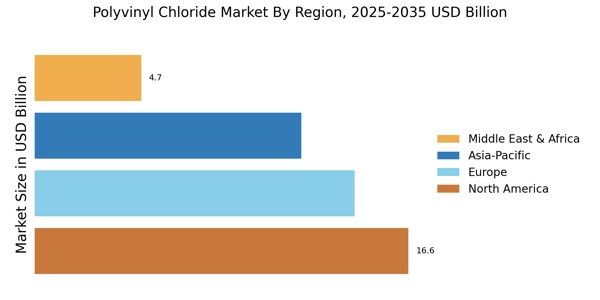

Rising Construction Activities

The Polyvinyl Chloride Market is experiencing a surge in demand due to increasing construction activities across various sectors. The material is favored for its durability, cost-effectiveness, and versatility, making it a preferred choice for pipes, fittings, and flooring. In recent years, the construction sector has seen substantial growth, with investments in infrastructure projects reaching unprecedented levels. This trend is likely to continue, as urbanization and population growth drive the need for residential and commercial buildings. Consequently, the demand for polyvinyl chloride products is expected to rise, further solidifying its position in the market. The construction industry's reliance on polyvinyl chloride for various applications indicates a robust future for the Polyvinyl Chloride Market.

Expansion of Packaging Applications

The Polyvinyl Chloride Market is experiencing growth due to the expansion of packaging applications. Polyvinyl chloride is widely used in packaging materials, offering excellent barrier properties, durability, and versatility. The rise in e-commerce and the demand for safe and efficient packaging solutions are driving this trend. As industries seek to enhance product protection and shelf life, the use of polyvinyl chloride in packaging is likely to increase. This growing demand for innovative packaging solutions suggests a positive trajectory for the Polyvinyl Chloride Market, as it adapts to meet the needs of various sectors.

Growing Demand in Automotive Sector

The automotive sector is increasingly adopting polyvinyl chloride due to its lightweight properties and versatility, which are essential for enhancing fuel efficiency and reducing emissions. The Polyvinyl Chloride Market is benefiting from this trend, as manufacturers incorporate PVC in various automotive components, including interiors, dashboards, and wiring insulation. The automotive industry's shift towards lightweight materials is expected to drive significant growth in the demand for polyvinyl chloride products. As the industry continues to evolve, the reliance on polyvinyl chloride for its advantageous properties indicates a robust future for the Polyvinyl Chloride Market.

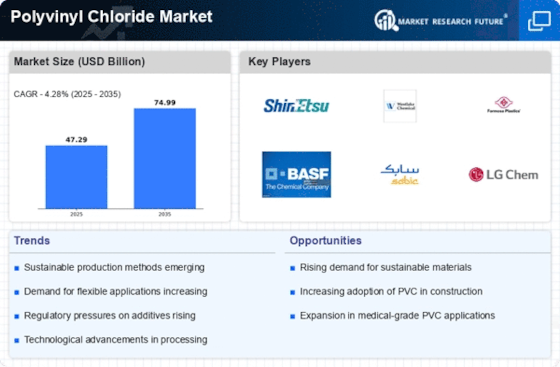

Technological Innovations in Production

Technological advancements in the production processes of polyvinyl chloride are significantly influencing the Polyvinyl Chloride Market. Innovations such as improved polymerization techniques and enhanced processing methods are leading to higher efficiency and lower production costs. These advancements not only improve the quality of PVC products but also expand their applications across different sectors, including automotive, healthcare, and packaging. The introduction of new technologies is expected to drive market growth, as manufacturers can produce more specialized and high-performance polyvinyl chloride products. This trend suggests a promising outlook for the Polyvinyl Chloride Market, as it adapts to evolving consumer needs.

Increased Focus on Sustainable Materials

The Polyvinyl Chloride Market is witnessing a shift towards sustainable materials, as environmental concerns gain prominence. Manufacturers are increasingly adopting eco-friendly practices, including the use of recycled PVC and bio-based additives. This trend aligns with global sustainability goals, as industries seek to reduce their carbon footprint. The demand for sustainable construction materials is projected to grow, with polyvinyl chloride being a key player due to its recyclability and lower environmental impact compared to alternatives. As consumers and businesses prioritize sustainability, the polyvinyl chloride market is likely to benefit from this growing preference, enhancing its appeal in various applications.