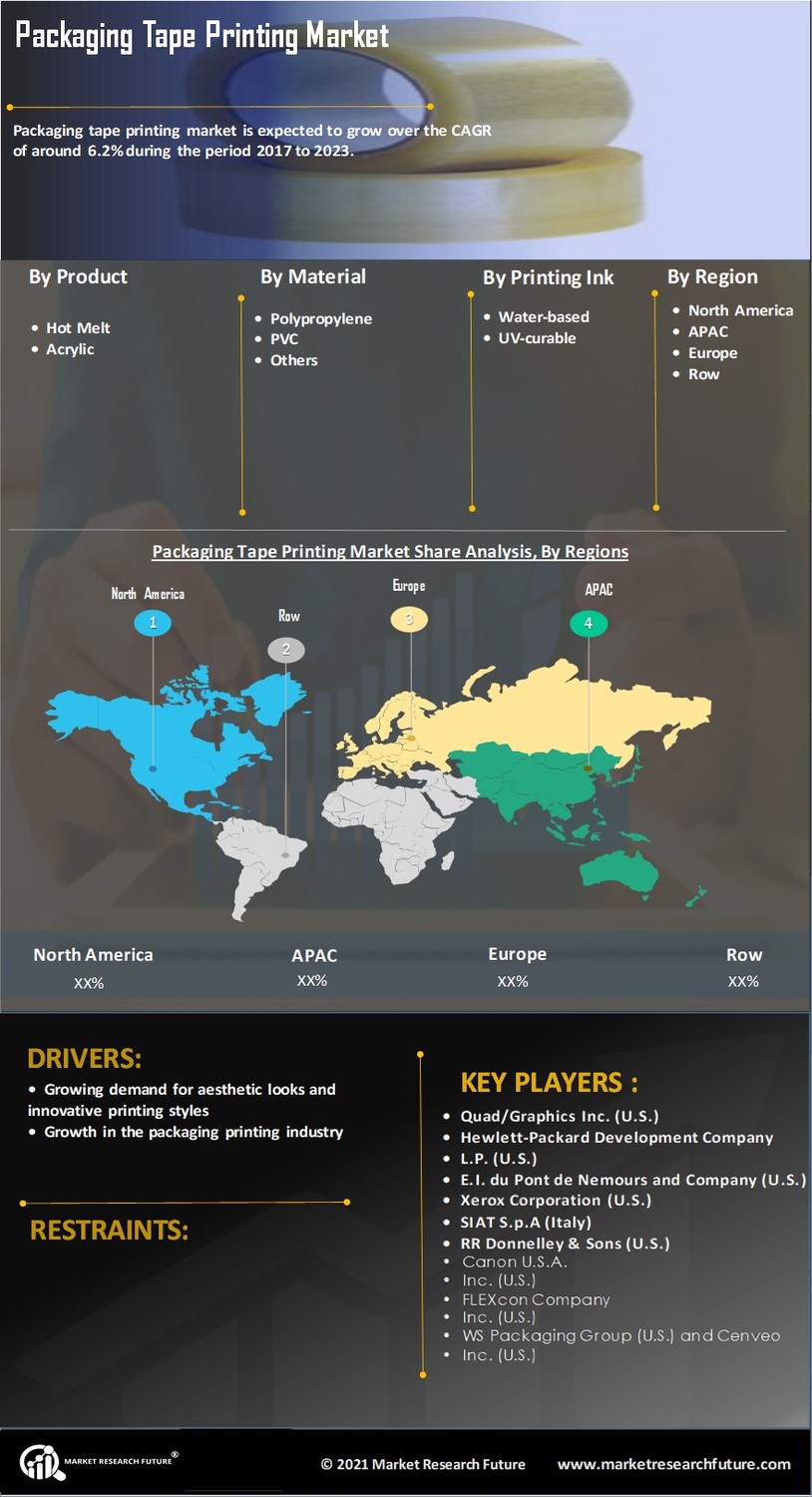

Rising Demand for Customization

The Packaging Tape Printing Market experiences a notable increase in demand for customized packaging solutions. Businesses are increasingly seeking to differentiate their products through unique branding and personalized packaging. This trend is driven by the need for enhanced consumer engagement and brand loyalty. According to recent data, the customization segment within the packaging industry is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This shift towards tailored packaging solutions is likely to propel the growth of the Packaging Tape Printing Market, as companies invest in advanced printing technologies to meet consumer preferences.

E-commerce Growth and Packaging Needs

The Packaging Tape Printing Market is significantly influenced by the rapid expansion of e-commerce. As online shopping continues to gain traction, the demand for effective packaging solutions that ensure product safety during transit is paramount. E-commerce businesses require reliable packaging tape that not only secures their products but also enhances brand visibility. Recent statistics indicate that e-commerce sales are expected to reach over 4 trillion dollars by 2025, which will likely drive the need for innovative packaging solutions. Consequently, the Packaging Tape Printing Market is poised for growth as companies adapt their packaging strategies to meet the evolving demands of the e-commerce sector.

Sustainability Initiatives in Packaging

Sustainability has emerged as a critical driver within the Packaging Tape Printing Market. Companies are increasingly adopting eco-friendly materials and practices in response to consumer demand for sustainable products. The shift towards biodegradable and recyclable packaging solutions is not only beneficial for the environment but also aligns with corporate social responsibility goals. Recent surveys indicate that over 70% of consumers are willing to pay a premium for sustainable packaging. This growing awareness is likely to influence the Packaging Tape Printing Market, as manufacturers innovate to create sustainable tape options that meet both regulatory standards and consumer expectations.

Regulatory Compliance and Safety Standards

The Packaging Tape Printing Market is also driven by the need for compliance with various regulatory standards and safety requirements. As industries such as food and pharmaceuticals face stringent regulations regarding packaging materials, the demand for compliant packaging solutions is on the rise. Companies are required to ensure that their packaging tape meets safety standards to avoid potential legal issues and maintain consumer trust. This regulatory landscape is likely to shape the Packaging Tape Printing Market, as manufacturers focus on producing tapes that adhere to safety guidelines while also providing effective branding opportunities.

Technological Innovations in Printing Techniques

Technological advancements play a pivotal role in shaping the Packaging Tape Printing Market. Innovations such as digital printing and flexographic printing have revolutionized the way packaging tape is produced. These technologies enable faster production times, higher quality prints, and greater design flexibility. As businesses seek to enhance their branding efforts, the ability to produce high-quality, vibrant prints on packaging tape becomes increasingly important. The market for digital printing in packaging is projected to grow significantly, indicating that the Packaging Tape Printing Market will likely benefit from these advancements as companies invest in modern printing solutions.