E-commerce Growth

The rapid growth of e-commerce is reshaping the landscape of the Commercial Vehicle Market. As online shopping becomes increasingly prevalent, the need for efficient logistics and delivery solutions intensifies. This trend is driving demand for commercial vehicles, particularly in the last-mile delivery segment. Companies are investing in fleets that can handle the surge in deliveries, with projections indicating that the last-mile delivery market could reach a valuation of over 100 billion dollars by 2027. This shift not only boosts sales for commercial vehicle manufacturers but also encourages innovation in vehicle design and functionality to meet the evolving needs of e-commerce.

Urbanization Trends

Urbanization trends are significantly influencing the Commercial Vehicle Market. As populations in urban areas continue to swell, the demand for efficient transportation solutions rises. This urban growth necessitates the use of commercial vehicles for logistics, public transport, and service delivery. The market is witnessing a shift towards smaller, more maneuverable vehicles that can navigate congested city streets. Additionally, the rise of last-mile delivery services is creating new opportunities for commercial vehicle manufacturers. It is estimated that the demand for light commercial vehicles will increase by approximately 10% in urban areas over the next few years, indicating a robust growth trajectory for the Commercial Vehicle Market.

Infrastructure Development

Infrastructure development is a critical driver of growth in the Commercial Vehicle Market. Governments worldwide are investing in transportation infrastructure to support economic growth and improve connectivity. This investment includes the construction of roads, bridges, and logistics hubs, which facilitates the movement of commercial vehicles. Enhanced infrastructure not only increases the efficiency of transportation networks but also encourages businesses to expand their operations, thereby increasing the demand for commercial vehicles. It is anticipated that infrastructure spending will rise significantly, potentially exceeding several trillion dollars over the next decade, which will have a direct positive impact on the Commercial Vehicle Market.

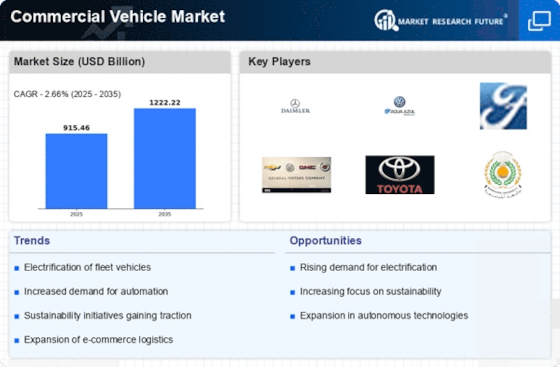

Sustainability Initiatives

The increasing emphasis on sustainability is reshaping the Commercial Vehicle Market. Governments and organizations are implementing stricter emissions regulations, which compel manufacturers to innovate and produce cleaner vehicles. This trend is evident as many companies are investing in alternative fuel technologies, such as hydrogen and electric powertrains. The market for electric commercial vehicles is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This shift not only addresses environmental concerns but also aligns with consumer preferences for greener options, thereby driving demand in the Commercial Vehicle Market.

Technological Advancements

Technological advancements are playing a pivotal role in the evolution of the Commercial Vehicle Market. Innovations such as autonomous driving, advanced telematics, and enhanced safety features are becoming increasingly prevalent. The integration of artificial intelligence and machine learning into vehicle systems is expected to improve operational efficiency and reduce costs. For instance, the use of telematics can lead to better route optimization, which may enhance fuel efficiency by up to 15%. As these technologies continue to develop, they are likely to attract investment and interest, further propelling growth in the Commercial Vehicle Market.