Evolving Consumer Preferences

Consumer preferences are shifting towards sustainable and efficient transportation options, which is positively impacting the Electric Light Commercial Vehicle Market. As awareness of environmental issues grows, businesses are increasingly seeking electric light commercial vehicles to meet the expectations of eco-conscious consumers. In 2025, surveys indicate that over 60% of consumers prefer companies that utilize electric vehicles for their deliveries. This trend is compelling businesses to adapt their fleets accordingly, thereby driving demand for electric light commercial vehicles. Moreover, the rise of e-commerce and last-mile delivery services is further amplifying this demand, as companies strive to enhance their operational efficiency while minimizing their carbon footprint. Consequently, the Electric Light Commercial Vehicle Market is likely to benefit from this evolving consumer landscape.

Government Incentives and Support

Government policies and incentives play a pivotal role in shaping the Electric Light Commercial Vehicle Market. Many governments are implementing financial incentives, such as tax credits and rebates, to encourage businesses to invest in electric light commercial vehicles. In 2025, it is projected that these incentives will lead to a significant increase in electric vehicle adoption, with estimates suggesting that up to 25% of new light commercial vehicle sales could be electric. Additionally, regulatory frameworks are being established to phase out fossil fuel vehicles, further propelling the transition to electric alternatives. This supportive environment not only fosters innovation but also enhances the competitiveness of the Electric Light Commercial Vehicle Market, as companies seek to align with governmental sustainability goals.

Advancements in Battery Technology

Technological innovations in battery technology are significantly influencing the Electric Light Commercial Vehicle Market. The development of high-capacity, fast-charging batteries is enhancing the performance and range of electric light commercial vehicles. In 2025, advancements in lithium-ion and solid-state batteries are expected to improve energy density, allowing vehicles to travel longer distances on a single charge. This is crucial for businesses that rely on light commercial vehicles for logistics and delivery services. Furthermore, the reduction in battery costs, which have decreased by nearly 80% over the past decade, is making electric vehicles more accessible to a broader range of companies. As battery technology continues to evolve, the Electric Light Commercial Vehicle Market is likely to witness increased adoption rates, further driving market growth.

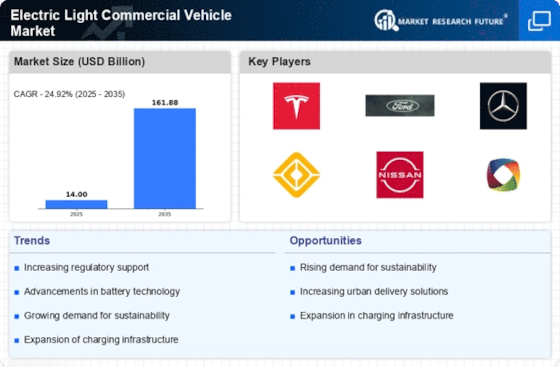

Rising Demand for Eco-Friendly Solutions

The Electric Light Commercial Vehicle Market is experiencing a notable surge in demand for eco-friendly transportation solutions. As businesses increasingly prioritize sustainability, the shift towards electric light commercial vehicles is becoming more pronounced. In 2025, it is estimated that the market for electric light commercial vehicles will reach a valuation of approximately 30 billion dollars, reflecting a compound annual growth rate of around 15%. This trend is driven by the need to reduce carbon emissions and comply with stringent environmental regulations. Companies are recognizing that adopting electric vehicles not only enhances their corporate image but also leads to long-term cost savings through reduced fuel and maintenance expenses. Consequently, the Electric Light Commercial Vehicle Market is poised for substantial growth as more businesses transition to greener alternatives.

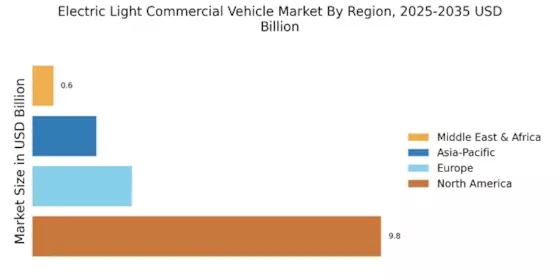

Infrastructure Development for Electric Vehicles

The expansion of charging infrastructure is a critical driver for the Electric Light Commercial Vehicle Market. As more businesses adopt electric light commercial vehicles, the need for accessible and efficient charging solutions becomes paramount. In 2025, it is anticipated that the number of public charging stations will increase significantly, facilitating the widespread use of electric vehicles. This development is essential for alleviating range anxiety among fleet operators and ensuring that electric light commercial vehicles can be utilized effectively for various applications. Furthermore, partnerships between private companies and governments to enhance charging networks are likely to emerge, creating a more robust ecosystem for electric vehicles. As infrastructure continues to improve, the Electric Light Commercial Vehicle Market is expected to experience accelerated growth, driven by increased confidence in electric vehicle technology.