Rising Fuel Prices

Rising fuel prices are a significant driver for the Global Electric Commercial Vehicle Market Industry. As traditional fuel costs continue to escalate, businesses are increasingly looking for cost-effective alternatives. Electric commercial vehicles present a viable solution, offering lower operational costs due to reduced fuel expenses. The financial benefits of electric vehicles become more pronounced as fuel prices rise, prompting fleet operators to consider the long-term savings associated with electric vehicle adoption. This trend is likely to accelerate the market's growth, as companies seek to mitigate the impact of fluctuating fuel prices on their operational budgets.

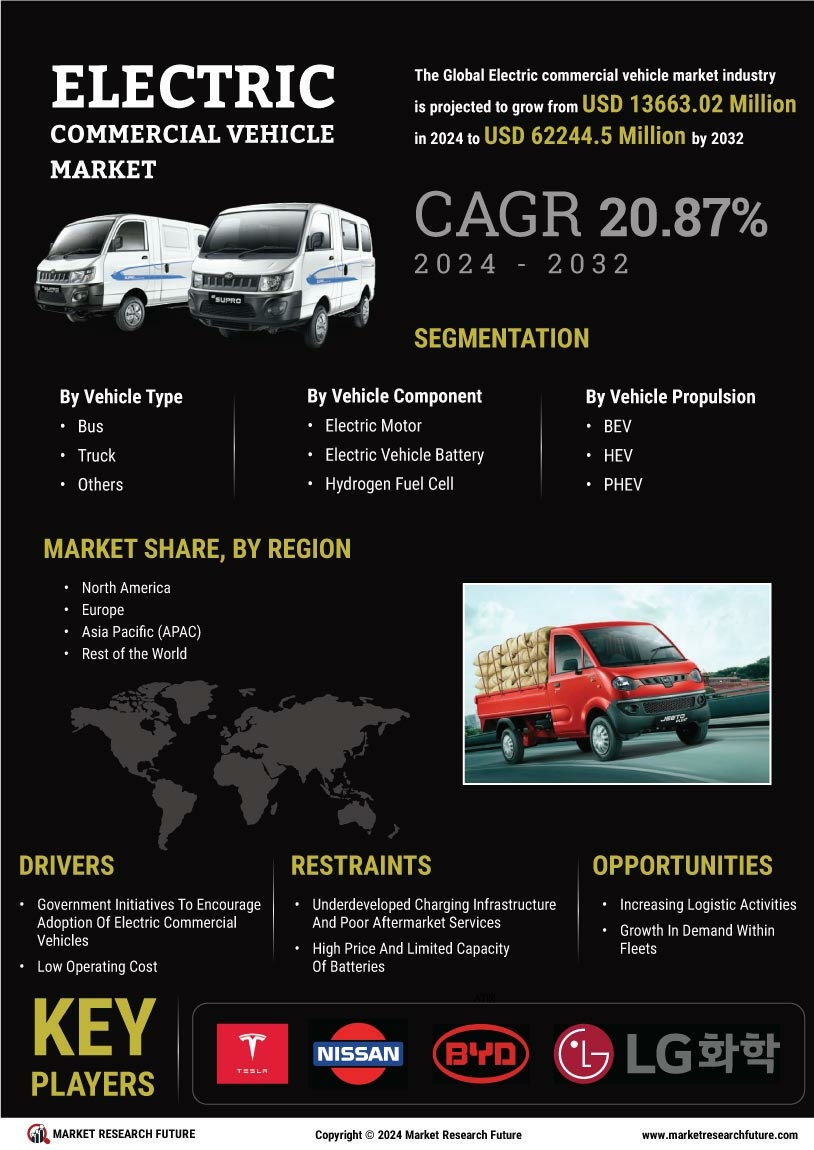

Market Growth Projections

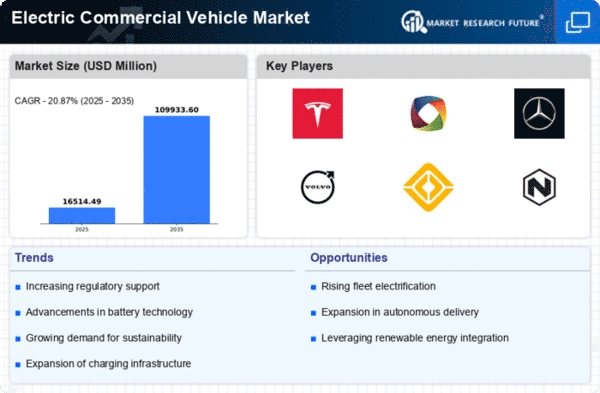

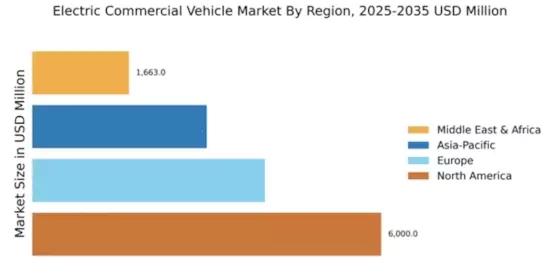

The Global Electric Commercial Vehicle Market Industry is poised for substantial growth, with projections indicating a market value of 13.7 USD Billion in 2024 and an anticipated increase to 109.9 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 20.87% from 2025 to 2035. Such figures reflect the increasing adoption of electric commercial vehicles across various sectors, driven by factors such as government incentives, technological advancements, and rising environmental awareness. The market's expansion is indicative of a broader shift towards sustainable transportation solutions on a global scale.

Growing Environmental Concerns

Growing environmental concerns are driving the transition towards electric commercial vehicles within the Global Electric Commercial Vehicle Market Industry. As climate change becomes an increasingly pressing issue, businesses are seeking sustainable solutions to reduce their carbon footprints. Electric commercial vehicles offer a cleaner alternative, emitting zero tailpipe emissions. This shift is supported by public sentiment favoring eco-friendly practices, which encourages companies to invest in electric fleets. The market is expected to grow at a CAGR of 20.87% from 2025 to 2035, reflecting the urgency to adopt sustainable transportation solutions that align with global environmental goals.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is crucial for the growth of the Global Electric Commercial Vehicle Market Industry. As more charging stations become available, the practicality of using electric commercial vehicles increases, alleviating range anxiety among fleet operators. Governments and private entities are investing in the development of robust charging networks, which is essential for supporting the widespread adoption of electric vehicles. This infrastructure growth is expected to facilitate a smoother transition to electric fleets, contributing to the market's projected growth to 109.9 USD Billion by 2035. A well-established charging network enhances the overall viability of electric commercial vehicles.

Government Incentives and Regulations

Government incentives and regulations play a pivotal role in shaping the Global Electric Commercial Vehicle Market Industry. Many countries are implementing stringent emission regulations, which compel businesses to transition to electric vehicles. For instance, in 2024, the market is projected to reach 13.7 USD Billion, driven by favorable policies such as tax credits and grants for electric vehicle purchases. These incentives not only reduce the initial cost of electric commercial vehicles but also encourage fleet operators to adopt greener technologies. As regulations become more stringent, the demand for electric commercial vehicles is likely to increase, further propelling market growth.

Technological Advancements in Battery Technology

Technological advancements in battery technology are significantly influencing the Global Electric Commercial Vehicle Market Industry. Innovations such as solid-state batteries and improved lithium-ion technologies are enhancing the efficiency and range of electric commercial vehicles. As battery costs decline, the total cost of ownership for electric vehicles becomes more competitive compared to traditional combustion engines. This trend is expected to contribute to the market's growth, with projections indicating a surge to 109.9 USD Billion by 2035. Enhanced battery performance not only extends vehicle range but also reduces charging times, making electric commercial vehicles more appealing to fleet operators.