Increased Cloud Adoption

The rapid adoption of cloud computing technologies is a crucial driver for the Global Cloud Security Industry. As businesses migrate their operations to the cloud, the need for comprehensive security measures becomes paramount. According to industry reports, the global cloud adoption rate is expected to continue its upward trajectory, with many organizations prioritizing cloud-first strategies. This trend is likely to propel the Global Cloud Security Market Size to an estimated value of 168.5 USD Billion by 2035, as organizations recognize the importance of securing their cloud environments against emerging threats.

Market Growth Projections

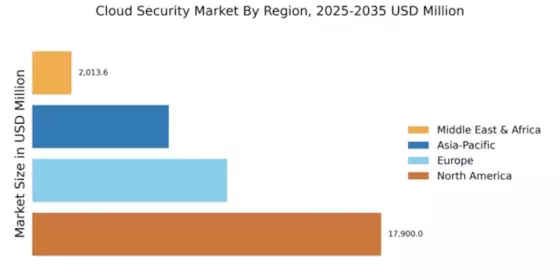

The Cloud Security Industry Size is poised for substantial growth, with projections indicating a market value of 35.9 USD Billion in 2024 and an anticipated increase to 168.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 15.09% from 2025 to 2035, reflecting the escalating demand for cloud security solutions. Factors such as rising cyber threats, regulatory compliance, and increased cloud adoption are contributing to this upward trend, positioning the Global Cloud Security Market as a critical component of modern business strategies.

Rising Cybersecurity Threats

The increasing frequency and sophistication of cyber threats is a primary driver of the Cloud Security Industry. Organizations are facing a surge in ransomware attacks, data breaches, and phishing schemes, necessitating robust cloud security solutions. For instance, the FBI reported a significant rise in cybercrime incidents, prompting businesses to invest heavily in cloud security measures. As a result, the Global Cloud Security Market Share is projected to reach 35.9 USD Billion in 2024, reflecting the urgent need for enhanced security protocols to protect sensitive data stored in the cloud.

Regulatory Compliance Requirements

Stringent regulatory frameworks across various sectors are compelling organizations to adopt cloud security solutions. Regulations such as GDPR, HIPAA, and CCPA impose strict data protection standards, driving the demand for compliant cloud security services. Organizations must ensure that their cloud environments adhere to these regulations to avoid hefty fines and reputational damage. This compliance imperative is a significant factor contributing to the growth of the Global Cloud Security Industry, as businesses increasingly seek solutions that not only secure their data but also align with regulatory mandates.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the Global Cloud Security Industry. These technologies enhance threat detection and response capabilities, allowing organizations to proactively address security vulnerabilities. By leveraging AI-driven analytics, businesses can identify anomalies and potential threats in real-time, significantly reducing the risk of data breaches. This technological advancement is likely to drive further investments in cloud security solutions, as organizations strive to stay ahead of increasingly sophisticated cyber threats.

Growing Demand for Remote Work Solutions

The shift towards remote work has significantly influenced the Global Cloud Security Industry. With more employees accessing corporate resources from various locations, the risk of data exposure and cyber threats has escalated. Organizations are increasingly investing in cloud security solutions that facilitate secure remote access, ensuring that sensitive information remains protected. This trend is expected to contribute to a compound annual growth rate of 15.09% from 2025 to 2035, as businesses seek to bolster their security frameworks in response to the evolving work landscape.