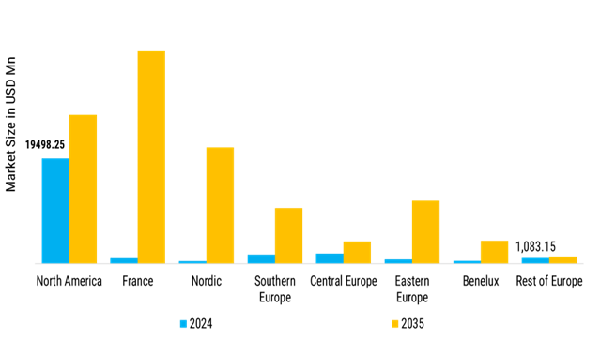

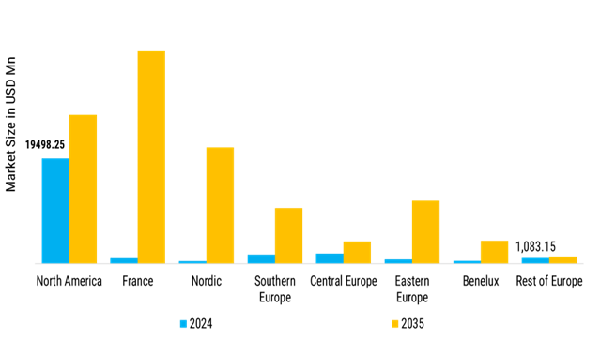

North America : most technologically advanced markets

North America represents one of the most technologically advanced markets for outdoor lighting controllers, driven by strong infrastructure, regulatory mandates, and widespread urbanization. The region leads in the deployment of smart lighting solutions across highways, commercial developments, and residential areas. The use of daylight harvesting technologies is spurred by government and utility programs, like rebates on energy efficient upgrades as well as daylight harvesting requirements. Meeting high standards of lighting organizations such as ASHRAE and IECC also entail lighting controls that push builders and municipalities towards automated lighting systems that adjust lighting to occupancy, ambient daylight, and planned events. The market is heavily characterized by retrofits, with cities like Los Angeles and Toronto upgrading millions of legacy streetlights to networked LEDs managed by smart controllers, yielding energy savings of up to 60% in some districts.

Europe : Historical infrastructure modernization

Europe’s outdoor lighting controller market is shaped by rigorous energy efficiency policies, aggressive smart city programs, and historical infrastructure modernization. Western Europe dominates the region due to high adoption of advanced LED and control technologies, particularly in countries like the UK, Germany, and France. UK cities such as London and Birmingham have overhauled their street lighting with networked controllers, enabling features like adaptive dimming and remote fault detection. Germany supports smart roadways, innovative parking solutions, and green architectural lighting through strong governmental funding and sustainability mandates. European Union directives, notably the Ecodesign and Energy Performance of Buildings Directive, require adaptive and efficient lighting controls in public and commercial spaces. These regulations propel widespread use of sensors, programmable controllers, and demand-response lighting in both new installations and retrofits.

Asia-Pacific : The fastest-growing region

Asia-Pacific is the fastest-growing region in the global outdoor lighting controller market, fueled by rapid urbanization, widespread infrastructure development, and ambitious government-led smart city strategies. The region features a mix of mature and emerging markets, with China, Japan, India, and South Korea leading adoption. The construction industry in China is already booming and the widespread smart city projects have led to the country-wide modernization of streetlights and architectural lighting to incorporate sophisticated controllers, frequently incorporating IoT, remote-scheduling and wireless communication protocols. India’s focus on sustainable infrastructure and energy reduction propels mass deployment of smart controllers across expanding metropolitan and tier-two cities. Energy conservation obligations and the strong growth of middle-class groups and commercial real estate also lead to healthy market growth. Governments are proactively promoting public-private alliances in LED retrofits and digital lighting control upgrades, as investment in wireless technology is rapidly exceeding that in wired solutions because it is simpler to implement in large urban settings.

Middle East and Africa : Smart city initiatives

South America is experiencing accelerating growth in outdoor lighting controller adoption, driven by urban expansion, modernization of public infrastructure, and rising energy costs. Key countries like Brazil, Argentina, and Chile are investing in smart city initiatives aimed at improving municipal services and environmental management. Brazilian cities are starting to undertake massive retrofits of streetlights with LED lamps with smart controllers that can dim adaptively, be remotely monitored, and detect faults, and this is often financed by international development agencies or utility joint ventures. Programs such as “Iluminaçao Pública Inteligente” in São Paulo leverage sensor networks and wireless mesh controls to improve energy efficiency and urban safety. Connected lighting technologies are being adopted at a slower pace in residential and commercial segments in the region than in North America or Asia-Pacific, because of limited capital investment and inconsistent enforcement of regulations. Cross-border collaborations and regional participation in international standards (such as those from IEC and ANSI) are facilitating the adoption of interoperable hardware and cloud-based software solutions.